Are Crypto Rug Pulls Illegal? And Why it is Not Worth It

Crypto rug pulls are illegal, and the risk-reward ratio is terrible—especially with tons of on-chain detectives checking daily. Learn more in this blog.

Whether or not crypto rug pulls are illegal depends on the specific circumstances.

If you need a black-and-white answer, rug pulls are illegal.

There are two types of rug pulls you need to know:

Hard Rug Pulls: Where developers code malicious backdoors into their tokens, are typically illegal. The hard rug pull chart looks similar to pump and dump charts.

Soft Rug Pulls: Where developers dump their crypto assets quickly, are more difficult to define as illegal but are still unethical and fraudulent. This is often difficult to trace but not impossible to trace, as more than 80% of soft rug pulls are traced to date.

This is not to be confused with crypto hacks, whereby the developers' incompetence resulted in the loss of users' funds. We covered in-depth how you could learn how to protect yourself from crypto hacks.

Crypto regulation is still in its early stages, and there needs to be a clear consensus on defining or prosecuting crypto rug pulls. However, some countries and jurisdictions are taking steps to address the issue.

The US Securities and Exchange Commission (SEC) has filed lawsuits against several cryptocurrency companies allegedly engaged in fraudulent activities, including rug pulls.

For example, let's take a look at Aurelien Michel, a French national residing in the United Arab Emirates (UAE) rug-pulled "Mutant Ape Planet" and is now immediately taken into custody right after landing at JFK airport in New York—he had zero clue that the police were waiting for him.

Even if a crypto rug pull is not technically illegal, recovering stolen funds can still be difficult because cryptocurrency transactions are pseudonymous and often irreversible.

Additionally, rug pull scammers often operate from jurisdictions with weak or nonexistent laws against cryptocurrency fraud.

What is a Rug Pull?

A rug pull is a type of cryptocurrency scam where developers create a new token and promote it to investors, only to suddenly abandon the project and take the investors' money with them.

This is often done by creating a liquidity pool for the token, which allows investors to buy and sell it. Once the token has gained some value, the developers will withdraw the liquidity from the pool, leaving investors with worthless tokens.

Rug pulls have become increasingly common in recent years as the cryptocurrency market has become more popular.

They are particularly widespread in the decentralized finance (DeFi) space, with less regulation and oversight. Even with tons of regulation in CeFi, rug pull is nearly impossible, but it is still possible. Learn about the difference between CeFi and DeFi here.

The risk of rugging (slow loan defaults) as known as slow default outside of DeFi can also be present in the real-world assets sector.

For example, Goldfinch, a Web3 platform, is now at risk of losing $7M after last year’s string of defaulted loans to crypto trading firms.

Top 5 Reasons Why It's Never Worth to Rug Pull Your Project

#1: It is illegal & unethical.

You could end up in jail—worst case, killed.

Besides Aurelian, here's another one. Ethan Nguyen and Andre Llacuna purportedly rug-pulling approximately $1.1 million in revenue by selling non-fungible tokens (NFTs) featuring whimsical characters known as "Frosties."

You wonder what happened next? They are now Aurelian's new friend.

Rug pulling is considered theft and fraud in most jurisdictions. Authorities like the SEC and FBI actively pursue rug-pull scammers, and penalties are severe. You'll likely face felony charges and years in federal prison if caught and convicted.

Your assets will be seized. Any profits you make will be paid back to victims.

You'll have a criminal record that will follow you for life. Employers will not want to hire you. Depending on the scale, you could be looking at decades behind bars.

No matter how clever you think your scam is, the law will catch up to you eventually.

#2: You will be hunted, and life will become a living hell

Rug pulling puts a target on your back. Swindled investors, law enforcement, and underground vigilantes will be gunning for you. You'll spend every moment anxiously looking over your shoulder, never knowing when you'll be caught.

The paranoia will eat you alive, and you won't be able to trust anyone for fear they will turn you in.

The shame and guilt of destroying innocent lives will keep you up at night. You'll have to cut off family and friends to protect your secret. But eventually, your dirty deeds will be dragged into the light. And then the absolute nightmare will begin.

Your freedom and reputation will be gone forever.

Rug pulling will turn your life into a living hell of fear and isolation.

#3: It destroys the cryptocurrency market in general

It destroys trust in the cryptocurrency market. Rug pulls tarnish the reputation of legitimate projects and dampen investor enthusiasm, resulting in everyone's Not Gonna Make It—similar to the story we covered about NGMI.

Each scam that happens erodes faith in the system. Investors become tired and reluctant to take chances on new, innovative startups. Venture funding dries up without willing participants.

Entrepreneurs are forced to close up shop. The rampant fraud could invite cumbersome government regulations restricting the entire crypto sphere.

The ecosystem you once loved begins to crumble. Liquidity decreases. Volatility increases. All because unethical rug pullers poisoned the well out of greed and short-sightedness.

Don't contribute to the downfall of something you likely believe in.

Rug-pulling your project tears at the fabric of the entire cryptocurrency market you depend on. The damage you do has ripple effects across the lives and businesses of countless others.

#4: You risk your entire life's record and work

Once word gets out that you ruthlessly rug-pulled vulnerable investors, you'll be blacklisted across the crypto industry.

All the years spent building up knowledge and connections will be erased. No legitimate project will ever partner with you again. Investors will scream your name as a warning to others.

Exchanges will ban you from listings. Influencers will denounce you as a scammer to avoid guilt by association.

Any accomplishments and contributions you've made will be forgotten. Your resume will go straight into the trash. You'll have to start entirely from scratch in a different field to feed yourself.

Was jeopardizing your entire career worth it? All that effort to become an expert is down the drain for short-term profits. Don't let unethical decisions upend your lifelong dreams and hard work.

The stigma of rug pulling will follow you professionally forever.

#5: You probably won't be able to cash out your stolen funds

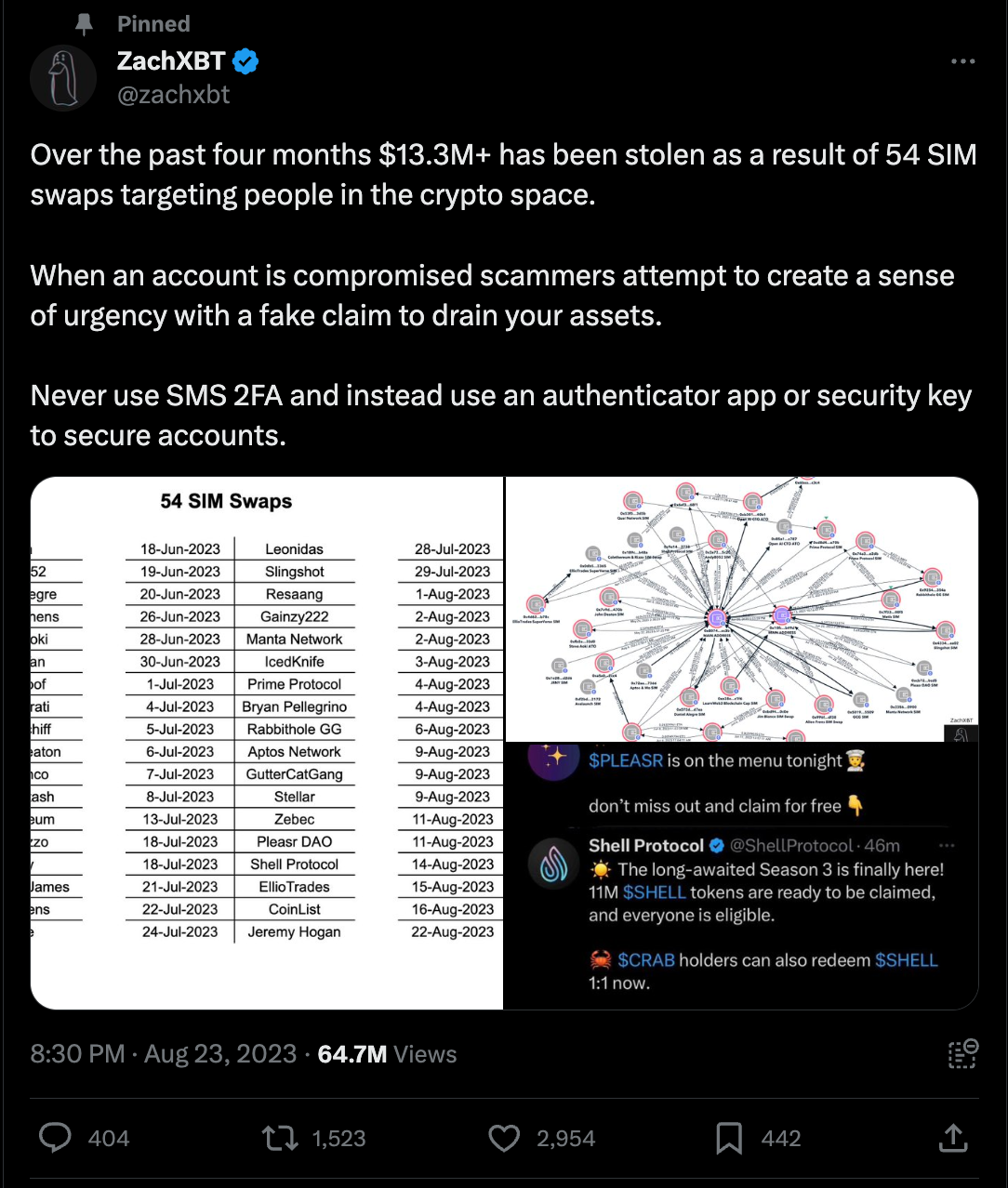

Sophisticated investors like Zachxbt will track transactions on the blockchain to hunt down your wallet addresses.

Exchanges will freeze your accounts once word spreads. Law enforcement will seize your ill-gotten crypto gains and auction them off to victims.

Civil suits will pick apart any remaining assets you attempt to hide.

Even if you manage to sneak some funds through, you'll look over your shoulder anytime you attempt to sell or spend funds linked to your scam. Trying to launder and enjoy the profits will be a nightmare. Any crumbs you manage to take won't be worth destroying your freedom and future over.

You'll never truly benefit from your betrayal in the end. All that unethical effort for some crypto you'll never fully control or use.

It's not worth risking for fruits that you couldn't fully enjoy.

What are the Worst Rug Pulls in 2023?

#1: Squid Game

The SQUID coin is poised for a comeback one year after a significant cryptocurrency scam, but the culprits behind it remain at large.

Last year, the SQUID coin generated significant excitement when it was launched on the Binance SmartChain.

However, it quickly led to the financial ruin of over 40,000 investors, surging from $0.01 to approximately $3,000 in just six days before crashing to zero.

The creators of the SQUID coin pulled off a rug-pull, leaving investors high and dry. This fraudulent project was introduced during the rise in popularity of the Netflix show "Squid Game," targeting Gen Z and millennial investors seeking rapid profits. It's important to note that Netflix has officially disclaimed any affiliation with the SQUID project.

#2: BALD

One day after Coinbase unveiled the Base network, someone launched a newly emerged meme coin known as $BALD, which was intended to poke fun at Coinbase CEO Brian Armstrong's baldness humorously.

It was meme excessively across X(Twitter), and impressions grew past 25M, boosting the memecoin visibility.

After experiencing a remarkable 3,000% surge in its overall value following its initial deployment, the token creator immediately withdrew a staggering $25.6 million in liquidity from the network—tanking $BALD by a 92%-98% decline in value, as indicated by data from CoinGecko.

I'd say it wasn't a BALD move, ba dum tss.

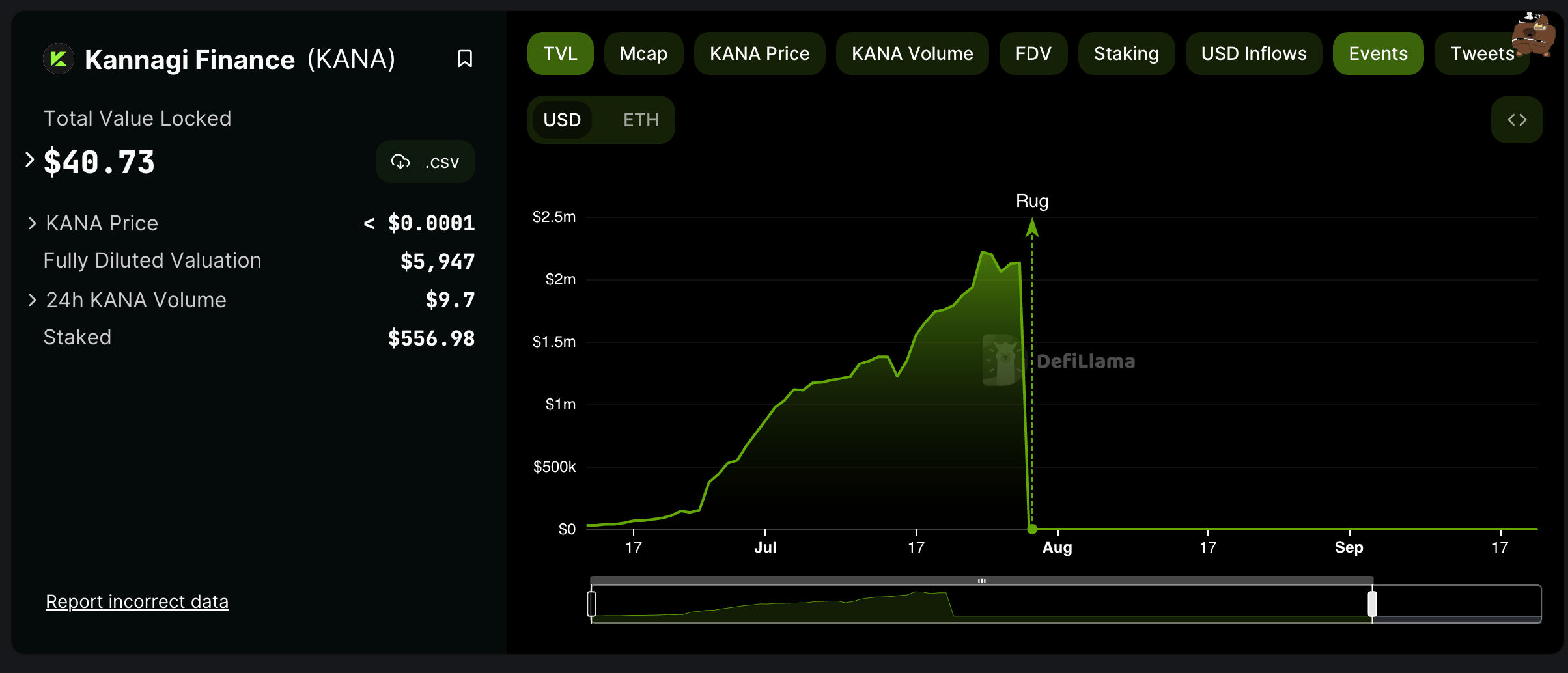

#3: Kannagi Finance

The Kannagi Finance rug pull was executed less than two months after the project's launch on the Ethereum Layer 2 platform, zkSync.

During this brief period, the project had amassed approximately $2.13 million in total value locked (TVL).

In the tumultuous events of July 2023, the rug pull siphoned nearly all of the value from the contract, leaving a mere $0.17 in TVL behind. The project's team went a step further by erasing their online presence, including their website, Twitter account, and GitHub code repositories.

It's worth noting that the code for the compromised vault contracts had undergone a security audit. However, the deletion of these contracts from GitHub has created a significant challenge in determining the precise method of exploitation.

Moreover, the fact that the launched contract code was unverified raises suspicions of potential malicious alterations introduced after the audit was completed.

#4: DeFiLabs

On July 27, 2023, the DefiLabs team issued a notice, indicating that the platform was temporarily undergoing maintenance, resulting in the temporary suspension of staking services.

The statement assured users that their funds would remain secure and accessible throughout the emergency upgrade process.

However, unbeknownst to users, behind the scenes, the DefiLabs team exploited a hidden function known as "withdrawFunds" to siphon approximately 1.4 million BSC-USD from the contract. Subsequently, these tokens were clandestinely transferred to a different address. (As of Oct 2023, the funds has been sent out to Binance.)

This rug pull orchestrated by DefiLabs capitalized on vulnerabilities within the smart contract code and a privileged address. While the presence of this backdoor was initially intended to enhance security by allowing the project team to withdraw funds, it inadvertently opened the door to potential abuse in the form of a backdoor attack.

A more decentralized and secure approach to managing privileged functions, such as employing a multi-signature wallet or implementing a decentralized governance scheme, could have averted this attack.

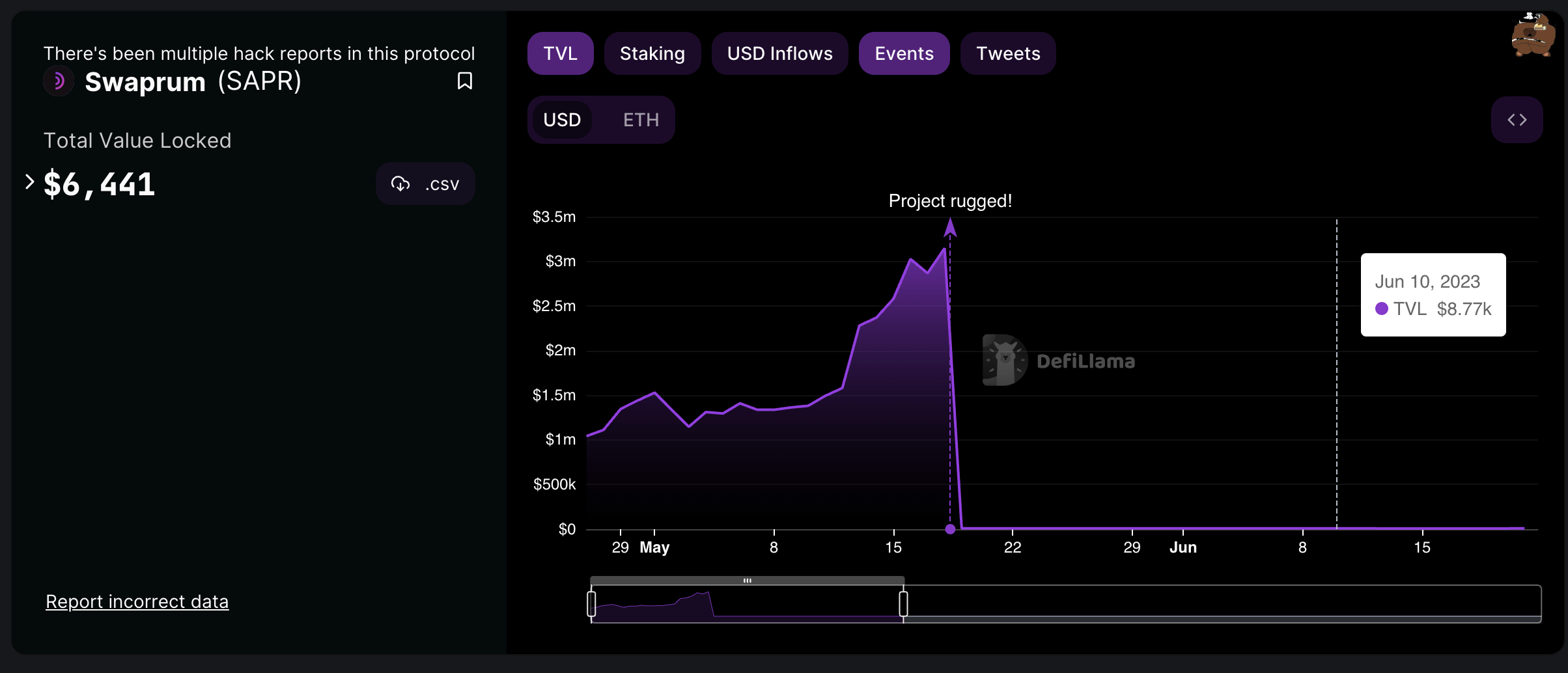

#5: Swaprum

Swaprum, a decentralized exchange (DEX) operating on the Arbitrum network, is suspected of orchestrating a rug pull, resulting in the disappearance of $3 million in customer deposits from the platform.

A rug pull, also known as an exit scam, is a fraudulent maneuver in which a seemingly legitimate project accumulates investments or user deposits and then suddenly shuts down operations, absconding with the capital, often without leaving a trace if they have taken appropriate precautions.

According to a tweet dated May 19 from the alert-focused account of blockchain security firm PeckShield, the individuals responsible for this scheme made off with 1,628 ETH, equivalent to approximately $2.95 million at current market prices, from Swaprum's liquidity pools.

They subsequently transferred these funds to the Ethereum network and effectively concealed their origins by "laundering" most of the ill-gotten gains through a cryptocurrency mixer called Tornado Cash.

#6: Kokomo Finance

Kokomo Finance, a lending protocol operating on the Optimism network, is under suspicion of orchestrating an "exit scam" to the tune of $4 million, whereby user funds were siphoned from the platform exploiting a loophole in its smart contract.

Blockchain security firm CertiK raised the alarm regarding this "exit scam" in a tweet dated March 26. They pointed out that the Kokomo Finance (KOKO) token experienced a staggering 95% drop in value within a matter of minutes.

Furthermore, CertiK observed that Kokomo Finance swiftly removed all of its social media accounts immediately following the alleged rug pull.

According to CertiK's analysis, the party responsible for KOKO deployed an attack on the smart contract code of cBTC, a wrapped Bitcoin token.

This attack involved resetting the reward speed and halting the borrow function.

Subsequently, an address commencing with "0x5a2d.." granted approval to the new cBTC smart contract, enabling it to expend over 7000 Sonne Wrapped Bitcoin (So-WBTC), which is swapped to 141.58 wBTC in profit.

Zachxbt: The On-Chain Detective Goes Hunting for Rug Pulls

ZachXBT is a pseudonym used by an anonymous blockchain detective who is known for exposing NFT projects, influencer rug pulls, and other financial misconduct in the cryptocurrency industry.

He first joined Twitter in 2015, but his pro-bono Web3 detective career started in May 2021 when he spotted the first NFT scams. Since then, ZachXBT has used his impressive chain analysis experience to dive deep into every project or person, raising eyebrows.

ZachXBT has exposed tens of NFT projects and influencers, including BitBoy and Tai Lopez. As of October 2023, BitBoy is no longer BitBoy since he has been ousted by his team members.

He has also been involved in a number of high-profile investigations, such as the collapse of the TerraUSD stablecoin and the ongoing legal battle between Ripple and the US Securities and Exchange Commission.

ZachXBT's work has been praised by many in the cryptocurrency community, but he has also been criticized for his sometimes aggressive tactics and his willingness to make allegations without providing concrete evidence.

In June 2022, ZachXBT was sued for defamation by NFT trader MachiBigBrother, who accused ZachXBT of making false and misleading statements about him. The lawsuit was later dropped.

Despite the criticism, ZachXBT remains one of the most respected and influential blockchain detectives in the cryptocurrency industry. His work has helped to expose a number of fraudulent and unethical actors, and he has played a significant role in making the industry safer for investors.

ZachXBT is a controversial figure, but there is no doubt that he is a force to be reckoned with in the cryptocurrency world.

Conclusion

Crypto rug pulls are illegal, and the risk-reward ratio is terrible—especially with tons of on-chain detectives checking daily.

Don't rug pull! And don't be greedy.