What to Own When the Dollar Collapses: Fiat Currency Collapse | 2024 Edition

In this article, we delve deep into the possibilities of a fiat currency collapse and discuss what to own when the dollar collapses—Updated for 2024.

With thousands of years on the humanity timeline, civilizations, countries, and empires have risen and fallen at various times. However, one commonality at the end of these events is the collapse of their currency and economy.

We delve deep into the possibilities of a fiat currency collapse and discuss what to own when the dollar collapses.

In this article, we will also break down the vulnerabilities of fiat currencies and explore the potential consequences of a fiat currency collapse. And how the global monetary system is changing by analyzing the signs of a possible dollar collapse, assessing how likely it is, and predicting how long it might take.

With increasing economic uncertainty over the US dollar, it's important to have a plan for when the dollar collapses.

Then, we'll also outline the steps you can take to protect yourself from and discuss the role of alternative investments, including real estate, precious metals, and cryptocurrency as a hedge against US dollar currency collapse.

The Greek drachma, the Roman denarii, the Venetian ducat, and, just a hundred years ago, the British pound sterling were all the dominant currencies of their time—also known as the true valuable assets of its time. All of them were eventually replaced. There's no reason the US dollar will be any different.

Whether the US dollar's collapse takes one, five, or even fifty years, it's a safe bet to assume it loses out eventually and that you should ensure you're ready for it.

That means it's more important than ever to understand what might happen and how to protect yourself.

Most importantly, we will talk about the top 6 assets you should own when the dollar collapses:

- Foreign Currency

- Precious Metals and Commodities

- Cryptocurrencies

- Real Estate Investments

- Emergency Supplies

- Alternative Investments

What is Fiat?

Like most of the world's currencies, the US dollar is a type of fiat currency.

A fiat currency is simply a currency that is not backed by a physical commodity, such as gold or silver, but by the government's promise to pay the bearer.

Unlike asset-backed currencies, fiat gives central banks more significant control over monetary policy, allowing governments to decide how much currency to print and set interest rates, which in turn, influences the currency's value.

As governments print more fiat and increase the monetary supply, the value of fiat goes down.

Consequently, economies experience inflation as prices rise to equilibrium with currency devaluation.

The World's Reserve Currency - What is the Dollars role?

The US dollar has been the world's dominant reserve currency ever since the end of World War 2 when the US emerged as the world's premier economic superpower.

Today, almost all international trade, investments, and debt are settled and denominated in dollars. National governments also hold a majority of their international currency reserves in US dollars, with roughly 60% of all foreign exchange reserves held in dollars, followed by the Euro at 20%.

Many countries also use the dollar as a benchmark to peg their currencies. Pegged currencies do not use a floating exchange rate and instead, rely on fixed exchange rates.

To do this, governments must hold extremely high currency reserves to maintain the peg, often in the form of US government treasury bonds.

This, in turn, helps to reinforce the role of the dollar as the world's reserve currency and lowers the cost of US government borrowing.

As long as there is high demand for the dollar, the risk of a complete collapse remains low.

The exact demand for the dollar depends on several factors, including its perception as a store of value, the US central bank's interest rate policy, its usefulness as an international medium of exchange, and, above all else, the US's position as the global economic leader.

Recently, there has been discussion regarding the potential replacement of the US Dollar, with a focus on the BRICS alliance, comprising Brazil, Russia, India, China, and South Africa. Will the currencies of BRICS nations potentially replace the US Dollar in the near future? As of now, there isn't sufficient evidence to support this claim, despite its speculation.

What Happens If The Dollar Collapses?

When the dollar collapses, most likely we will experience a massive changing world order where wars are initiated by global power to overturn the US reign of global power—both military and financially. This has been true for all major powers where it's currency was it's primary global currency of it's time.

As you may know, all powerful civilization's currency falls through time and one of the most famous hedge fund manager, Ray Dalio from Bridgewater Associates talked about this changing world order.

Here's a video from Ray in regards to changing world order:

To put in a clearer perspective, you would probably need to survive these events:

#1: Global Economic Turmoil

The US dollar is the backbone of international trade and finance. Its collapse would disrupt global markets, causing widespread economic instability.

International trade might freeze due to the uncertainty in currency valuation, leading to significant supply chain disruptions.

#2: Inflation and Domestic Economic Crisis

A collapsing dollar would lead to hyperinflation in the US. As the value of the currency plummets, prices for everyday goods and services would skyrocket, eroding purchasing power and savings.

This could lead to a severe economic downturn, with high unemployment rates and decreased consumer spending.

#3: Impact on International Debt

Many countries and foreign corporations hold significant amounts of their debt in US dollars. A collapse of the dollar would drastically change the real value of this debt, potentially benefiting debtors who would owe less in their home currency.

However, this could also lead to financial instability as the dynamics of international debt shift unpredictably.

#4: Flight to Other Currencies and Assets

In the event of a dollar collapse, there would likely be a massive flight to safety as investors and governments seek to protect their assets.

This could include moving investments to other currencies seen as more stable (such as the euro, yen, or Swiss franc) or to tangible assets like gold, real estate, or even cryptocurrencies, which could experience their own volatility in such a scenario.

#5: Reconfiguration of Global Power

The dollar's status as the world's reserve currency is a cornerstone of the United States' economic and geopolitical power.

Its collapse could lead to a significant reordering of international relations, with other countries or currency blocs gaining influence at the expense of the US.

#6: Potential for Social Unrest

The economic hardship and uncertainty resulting from a collapsed dollar could lead to widespread social unrest within the United States.

Economic instability often leads to political instability, with increased protests, strikes, and potentially a loss of faith in governmental institutions.

#7: Emergency Measures and Reforms

In response to a collapsing dollar, the US government and Federal Reserve would likely implement emergency measures to stabilize the currency and the economy.

This could include drastic interest rate increases, capital controls, or even a fundamental restructuring of the monetary system.

Signs that the US Dollar May be at Risk of Collapse

Here are some of the signs that you can detect yourself with a bit of research to prepare yourself:

#1: US National Debt Default

The biggest driver of a currency crisis is usually debt. Or, in other words, the threat of or actual failure to repay back it's loans.

Today, the US has a federal debt of over $28 trillion, well over 100% of its annual GDP output. And this number is continuing to grow rapidly.

However, the US debt is also denominated in dollars. Unlike other countries, this makes it virtually impossible for the US government to default on their debt, as they can always just print more dollars. Of course, turning on the money printers comes with its own risks.

#2: Money Printing and Inflation

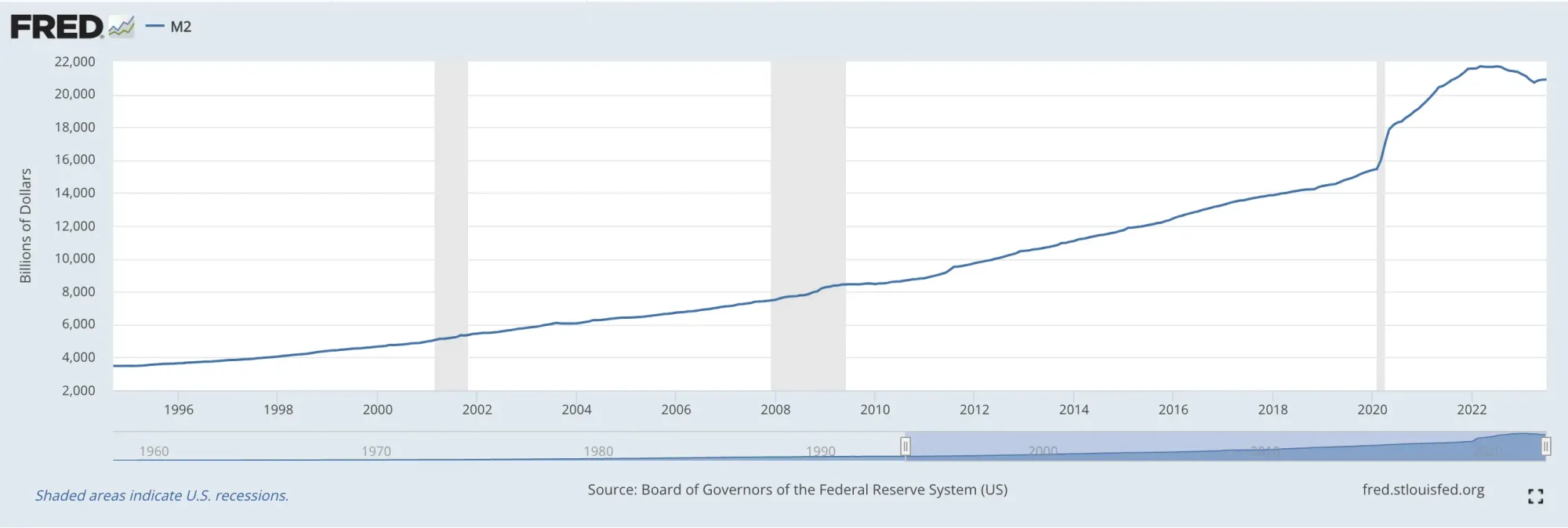

Potentially the biggest driver of a US currency collapse is the risk of rapid inflation. Over the last decade, loose monetary policy has rapidly expanded the money supply, resulting in huge asset-price inflation.

In other words, the US central bank (aka The Federal Reserve) has printed too much money; in 2020 alone, 23% of all US dollars in existence were printed. As the Federal Reserve prints more money, the relative value of each dollar goes down.

If the value of a currency rapidly depreciates, then inflation, or even hyperinflation, can quickly result in currency collapse.

#3: Geopolitical Shifts

A huge component of US dollar demand is driven by its role as the international reserve currency. By extension, if the dollar ever loses its global reserve currency status, we can expect the dollar's value to decline significantly.

As the US's relative economic power continues to decline, other countries such as China, Russia, and even France are slowly pushing to reduce the role of the US dollar as the sole global reserve currency.

The US's recent moves to exclude certain adversaries from the global economy have also accelerated concerns about the dollar's dominance and have catalyzed efforts by China, Russia, and others to reduce the world's international reliance on the US dollar.

When Will The Dollar Collapse Take Place?

History never repeats itself, but it often rhymes. Thus by looking at past currency collapses, we can try to make an informed prediction about what the US dollar's collapse might look like.

Past Examples of Fiat Currency Failures

German Hyperinflation

History has shown that fiat currencies can and often do fail, sometimes spectacularly. The most famous example is the German hyperinflation of the 1920s.

The huge burden of paying back reparations after WW1 forced the German government to print money to service their debt. The more they printed, the quicker the German mark fell, causing rapid inflation. In 1919, one dollar was worth 49 German marks. By 1923, it was worth a whopping 4,210,500,000,000.

Nevertheless, the comparison doesn't entirely work. Whilst the US does face an increasing debt problem and higher than average inflation, it is both a much stronger economy than Germany was in 1918, and its debt is denominated in dollars, making the possibility of a debt default and complete economic collapse less likely.

Roman DenariI

The collapse of the Roman denarii, and along with it, the empire itself took over two centuries. As Rome rapidly grew and conquered its neighbors, the costs of its military went up too. So, how did the Roman emperors afford it?

The solution was to debase (devalue) their currency. In other words, print more money, similar to what the US does today.

The denarii were initially backed 1:1 by silver, but over the course of 200 years, the denarii were slowly diluted by subsequent Roman emperors until, at last, it was only backed by 5% silver.

As a result, confidence in the Denarii fell, inflation increased, and the ensuing economic crisis eventually destroyed the Roman empire itself.

The Pound Sterling

Perhaps the most relevant comparison is the British pound sterling. During the latter half of the 19th century, at the zenith of the British Empire's commercial and military power, around 60% of the world's trade was settled in sterling.

Even as the empire's influence faded, and Britain's economy was surpassed by the United States in the 1920s, the pound sterling remained the world's dominant reserve currency until the 1950s, when racked by debt from WW2, a crumbling empire, soaring inflation and a substantial current account deficit, the greenback finally pushed it aside.

But this process took over 30 years, and the British economy then, while not entirely dissimilar, was in a much worse state than the US today, suggesting that the dollar's decline, while certainly coming, could take some time yet.

What does this all mean?

Nevertheless, there is a common theme among all these examples.

A formerly prosperous economy—burdened by extreme debt (often from military interventions), declining economic confidence, and rival economic forces emerging to challenge or replace it.

All of these factors are true for the US today.

How long exactly it takes for the US dollar to reach its inevitable conclusion is anyone's guess.

Nevertheless, it pays to prepare early rather than too late.

Here are the Top 6 Assets You Should Own When the Dollar Collapses

So, now you know that the dollar collapse is a question of when not if; the real question is what you should Own When the Dollar Collapses to protect yourself.

Luckily for you, we're here to help break down all of these asset classes so you don't have to rely on pooling on others or through mutual funds beyond your control.

Ultimately, the effectiveness of your strategy will depend on how exactly the collapse plays out. A total implosion? Shotguns and lots of ammo might be your best bet. A gradual decline, on the other hand?

Then, a range of more traditional investments will probably make more sense.

Either way, we've covered all the bases with our comprehensive guide on what to own when the dollar collapses.

Asset #1: Foreign Currency

If the dollar goes down, then it automatically implies that foreign currencies must go up. That makes owning foreign currencies a good hedge against the dollar, especially currencies that have proven themselves to be effective stores of value.

Not to be confused with foreign stocks, usually, when the dollar is heavily affected, foreign stocks take a beating too.

The most popular reserve currencies besides the dollar include the Euro, the Chinese yuan (aka renminbi), the British pound sterling, and the Japanese yen. Nevertheless, most of these currencies have actually weakened against the dollar over the last 20 years.

Some more minor currencies, on the other hand, may prove better bets. The Swiss franc, for example, is up 100% against the dollar over the last 40 years.

But, the Swiss Franc is probably the ONLY fiat currency that outperformed USD. If you compared it to other rising and failing economies globally, you will notice a trend.

| Currency | 2014 (Value Against USD) | 2024 (Value Against USD) | Change in Percentage (%) |

|---|---|---|---|

| BTC | 732.0000 | 39834.0000 | 5341.80 |

| SPX | 1845.86 | 4864.61 | 163.54 |

| GOLD | 1205.0000 | 2026.0000 | 68.13 |

| SILVER | 19.4400 | 22.4700 | 15.59 |

| CHF | 1.1190 | 1.1510 | 2.86 |

| CNH | 0.1640 | 0.1390 | -15.24 |

| KRW | 0.000942 | 0.000745 | -20.91 |

| CAD | 0.9405 | 0.7428 | -21.02 |

| EUR | 1.3770 | 1.0860 | -21.13 |

| GBP | 1.6470 | 1.2700 | -22.89 |

| Crude Oil | 98.44 | 74.55 | -24.27 |

| INR | 0.01616 | 0.01202 | -25.62 |

| JPY | 0.00949 | 0.00676 | -28.77 |

| MYR | 0.3048 | 0.2108 | -30.84 |

| BRL | 0.4280 | 0.2015 | -52.92 |

| TRY | 0.4650 | 0.03262 | -92.98 |

| ARS | 0.1528 | 0.00122 | -99.20 |

If you think a modern societies' currency cannot fail, here's some examples of modern currencies look like against USD as of today, including how Bitcoin outperformed USD in the past 10 years.

Asset #2: Precious Metals and Commodities

Whilst fiat has a theoretically endless supply, precious metals, and other commodities with fixed (or at least bounded) supply such as gold, oil or corn in a form of physical assets could be a better bet. Not only is the supply of these products limited, their demand is driven by real-world usage rather than simply popular perception.

The most popular store of value has always been physical gold. Up until the 1970s, most currencies were even backed by gold or other precious metals including silver. And this historical perception of gold as the 'gold standard' of safe haven assets still exists today, making it a good option as a hedge against economic uncertainty.

Looking at this chart for gold prices from 2014 till 2024, it has went up by 68.13%. Which is far higher compared to silver, which only grew by 15.59% within the same time frame.

Although gold prices fluctuate all the time, it is still considered one of mankind's known safe havens during economic turmoils.

This effect can be observed in the 2007-2008 financial crash, where the price of gold over doubled in less than three years as investors fled towards the world's most traditional 'safe haven' asset.

Alternatively, you could look at other commodities with more practical demand. This could include rare earth metals used to build batteries and other tech products, good old-fashioned grubby oil, or even food and crops such as wheat. People will always need phones, transportation and food after all. The best way to get exposure to commodities is often through an index fund.

Though we mentioned the traditional reliance on crude oil, particularly during pandemics or wars when people often rush to accumulate gas in anticipation of potential energy shortages, the data might suggest a different trend.

Over the past ten years, from 2014 to 2024, crude oil has experienced a decrease of 27.17% in value, dropping from $98.52 to $74.54.

It's also important to note that at the onset of COVID-19, crude oil underwent a significant drop in value of around 70% within just three months.If climate change is going to be as bad as many predict it will be, then even water tanks and solar panels could be a good bet.

Asset #3: Cryptocurrencies

Cryptocurrencies are a form of decentralized currency that has become an increasingly popular investment class in recent years, with some people believing that they could play a significant role in the decline of the Dollar monetary system.

Unlike fiat, cryptocurrency supply is not controlled by the government. Most are decentralized and designed with a fixed maximum supply, like Bitcoin, or in other cases, even have deflationary total supply.

This means that, unlike fiat currencies, the scarcity of many cryptocurrencies will only ever increase, making them a potentially helpful store of value.

In many countries with unstable fiat currencies, such as Turkey or Nigeria (We covered about Nigeria crypto scene and trend here), where inflation has wiped out people's savings, Bitcoin has become a popular alternative, where it is often seen as a form of 'digital gold'.

Many cryptocurrencies are also known as 'utility tokens', meaning they accrue value via demand for their services, including Ethereum, Filecoin, or Creditcoin.

However, it is essential to remember that cryptocurrencies are still a relatively new technology and can be volatile. Some cryptocurrencies even have token supply systems (tokenomics), which are even more inflationary than fiat.

Asset #4: Real Estate Investments

Real estate can be an excellent investment both before and after a currency collapse.

Before a collapse, it may be wise to invest in property that can be used for self-sufficiency, such as a farm or a home with a large garden.

After a collapse, real estate may be one of the few assets that still holds value, as people will always need a place to live.

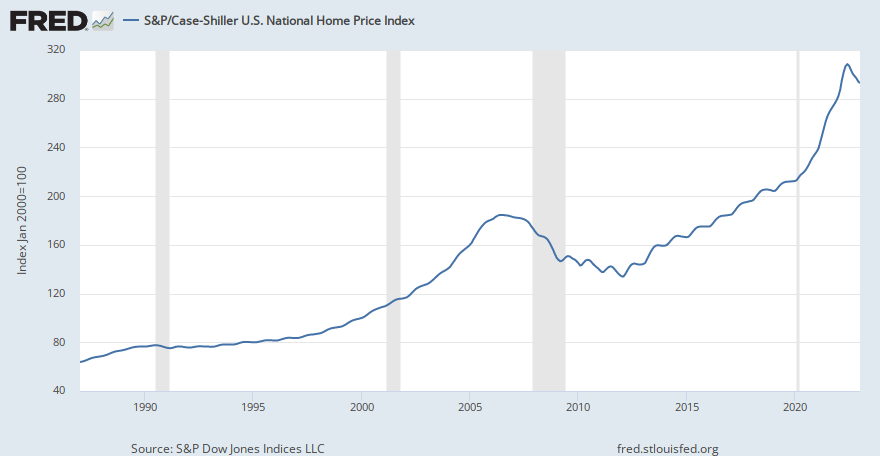

One thing to note about this strategy is that the best time to buy is often in the midst of a financial crash. Economic crisis often result in people losing their jobs and defaulting on their mortgages, resulting in lots of properties hitting the market.

This means lower prices to buy. Indeed, if you look at US housing price indexes, you'll see that the best time to buy is shortly after a sharp economic contraction, as was the case with the 2007-2008 financial crash.

Investing in a foreign property market may be particularly lucrative, although this can come with legal challenges and additional risks. Moreover, it's not just the US where property markets are overheated; it is currently a global phenomenon.

Asset #5: Emergency Supplies

If a worst case scenario event really does happen, and the US goes the way of the Weimar Republic, then it's essential to have emergency preparedness plans in place.

This includes having a stockpile of food, water, medicine, and other necessities that can last for several weeks to several months. Plus, having extra supplies is safer than nothing, as you can always barter them for other valuable goods if needed.

Additionally, having a backup source of power and a way to protect oneself and one's property. If you live in a country where firearms are legal, why not stock up and prepare?

Self-sufficiency is also crucial. This means growing your own food and providing to your loved ones without relying on the government or others.

This can include learning how to grow a garden, raise animals, and make essential household items. This means books might also be a good investment, and unlike a Kindle or phone, you can still use them without internet access.

Having said all this, total anarchy isn't our prediction, despite what some doom-mongers may say. Certainly, we wouldn't recommend losing any sleep over it—well, you can't sleep with a stranger hitting your door with crowbars.

Asset #6: Alternative Investments

There are also some other investments you could make. Fine art, for example, has performed well over the last century. Wine, Whiskey, and other scarce luxury goods could work too.

The challenge here is storage and uncertainty of whether luxury goods will hold their value in the face of an overwhelming economic catastrophe—like how the watch prices soured up during the COVID era combined with the insane money printing in action.

However, watches are way too speculative since it's demand can be artificial inflated by watch brands. Some collections may work but it is very unlikely that you would do well trying to accumulate this asset class based on the market data since not all watches within the top brands are always going to be the 'hot model'.

Conclusion and Final Thoughts

In conclusion, while it is impossible to predict when or if a currency collapse or even bank run will occur, it is wise to be prepared.

While there's no reason to start packing for doomsday, you should start planning your long-term investment strategy around the actual likelihood of a US dollar collapse.

This includes having emergency preparedness plans in place and diversifying yourself across various investments, including real estate, commodities, cryptocurrencies, and other alternative investments.

Although this article is not a piece of financial advice, but understanding the current situation will put you in a better position because you know what to own when the dollar collapses—or the fiat currency goes the way of the dodo.

Updated by Joshua Yap on 24th January, 2024.