Top 6 Real-World Assets (RWAs) Platforms in 2023

Explore the Top 6 RWA investment platforms including the risks and it's USDC yield return annually. Read this blog to learn more.

Real-world assets, or RWAs, connect the DeFi ecosystem to real-world asset markets.

However, despite its enormous potential, only a few DeFi platforms have been able to bridge the gap between the worlds of off-chain and on-chain finance, attracting good USDC yield.

Despite all this excitement, it’s important to remember that trade-offs and risks are involved in this process.

The off-chain and on-chain worlds don’t always mesh together smoothly, and for all the promises of decentralization, real-world investment inevitably hits the barrier of real-world regulation at some point.

Read More: The Future of Real-World Asset Tokenization Explained

Nevertheless, the melding of traditional finance investments and DeFi protocols creates an entirely new industry of exciting platforms where you can earn incredible rates on your USDC.

Today, we’ll explore how these RWA investment platforms work, highlight the top DeFi protocols working in RWA investment today, and finally, outline some of the risks associated with each. Let’s dive in!

Within further ado, here are the top 6 Real-World Assets (RWAs) platforms within our picks:

- Gluwa via Creditcoin (CTC)

- Maple Finance (MPL)

- Goldfinch (GFI)

- Centrifuge (CFG)

- Ondo Finance (ONDO)

- Clearpool (CPOOL)

For each platform, we will outline how the DeFi protocol works, its key features, potential risks, and the USDC APY returns they offer.

#1: Gluwa

Gluwa is one of the leading real-world asset platforms today, combining expertise in traditional emerging market debt financing with a unique protocol-led approach to investment.

The Creditcoin protocol requires any potential fundraisers to record their loan performance on it’s native L1 blockchain, providing investors with a transparent and immutable ledger of credit history.

At the time of writing, the Creditcoin blockchain has recorded over 3M real-world loans. Using this information, DeFi investors can then choose to make investment through Gluwa’s Investor DAO.

In partnership with the Gluwa Fund, Investor DAO members are regularly offered various RWA Investment Opportunities with emerging market fintech lenders working on Creditcoin.

These fintechs operate in countries like Nigeria, Kenya, Singapore, Mexico and many others. To-date, the Investor DAO has closed over 7 deals, with a 100% repayment rate.

Key Features

- Creditcoin Blockchain: The Creditcoin blockchain is designed to record loan performance of borrowers, lenders and investors to increase transparency and security throughout its RWA ecosystem. The upcoming Creditcoin 3.0 update will deliver EVM-compatability and Universal Smart Contracts, which aim to deliver a native multi-chain RWA investing experience.

- Investor DAO: The Investor DAO represents a marriage of traditional and decentralized finance, allowing members to access unsecured lending opportunities with as little as $1 USDC.. These deals are audited and sourced by the Gluwa Fund LP and can then be rejected or approved by the DAO members. As part of this process, DAO members also receive confidential access to a variety of materials, including business reports and more. KYC is required to join.

- Emerging Market Fintech Lending: The platform’s investment activities are focused exclusively on lending to real-world fintech lenders in emerging markets. By operating in these high-growth sectors, investors can earn sustainable yields on their USDC whilst hedging their crypto exposure.

Risks/Disadvantages

- Unsecured Lending: Unlike many popular DeFi protocols, Gluwa’s RWA investments involves unsecured lending. This means that there are counterparty risks, with investors potentially losing their funds in the case of borrower default. Nevertheless, to-date, there have been 0 defaults on Gluwa’s RWA investment platform, with legal protections in place to protect investors and recover funds in cases of default.

- Limited Deal Availability: Due to a heavy focus on deal-screening and risk management, only a limited number of Investment Opportunities (7) have been made available on the platform since launch. However, lower-yield, flexible withdrawal products are more consistently available.

- Auditor Centralization Risk: Investment Deals are sourced and assessed by a professional but centralized counterparty — the Gluwa Fund LP. This creates a risk of human oversight or error. However, this risk is present in almost every RWA investment platform today.

Gluwa’s USDC Yield = 4 → 20% APR

Gluwa’s USDC yield varies based on the exact investment.

Headline Investor DAO Investment Opportunities usually offer anywhere between 10–20% APR, with a standard tenure of 1 year and monthly repayments.

Alternatively, the investment platform also offers flexible investment accounts such as the Gluwa Lottery, which offers anytime withdrawals in return for 4% on average.

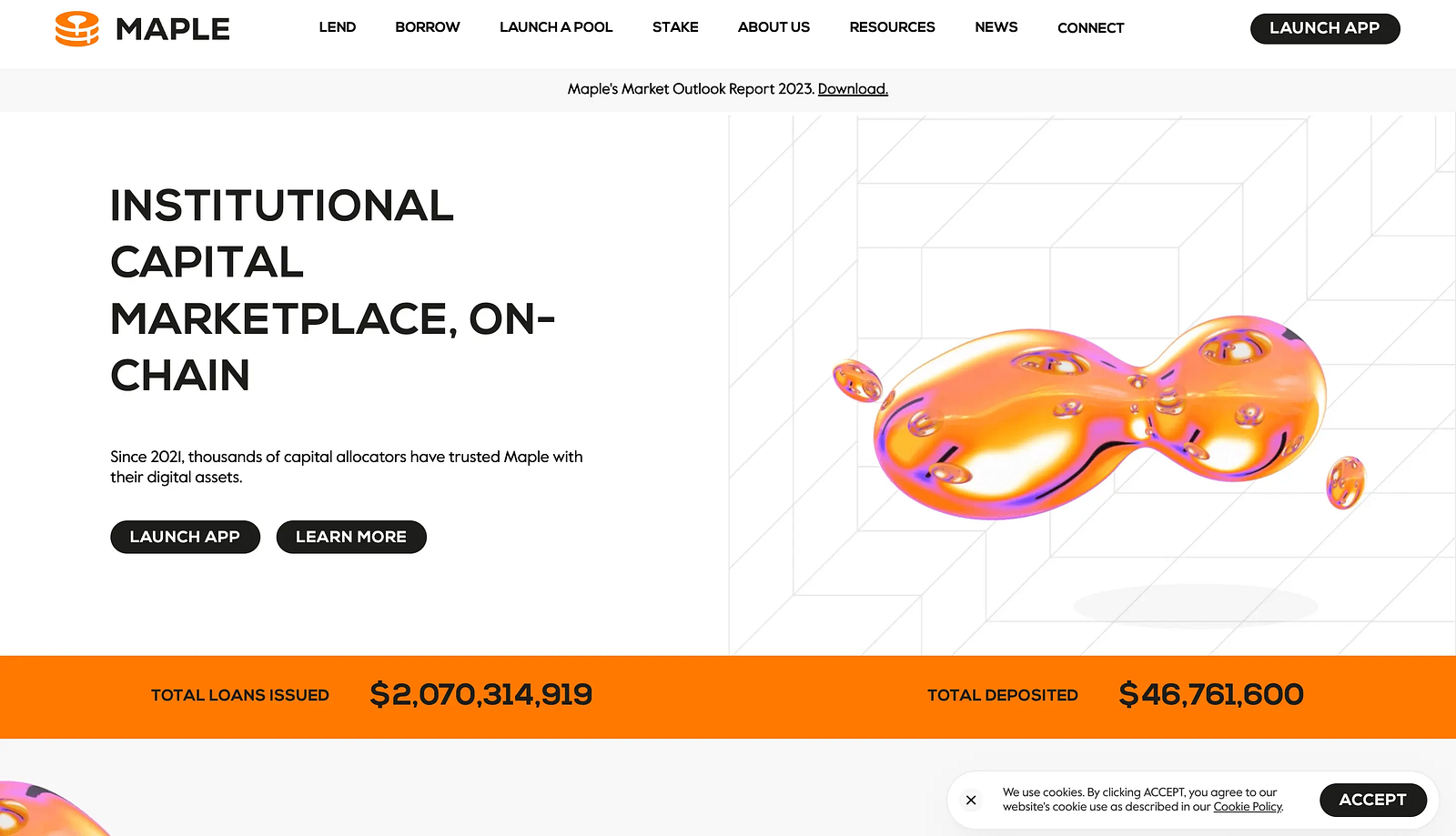

#2: Maple Finance (MPL)

Maple Finance is a decentralized credit market that allows institutional borrowers to obtain unsecured crypto loans. One of the biggest and most popular DeFi protocols yet, the lending protocol has originated over $2b in loans on its platform.

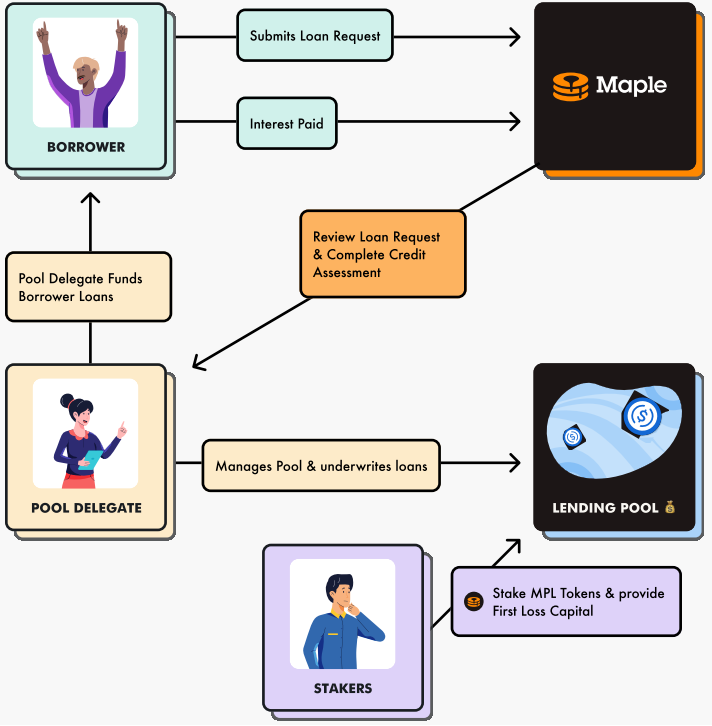

Maple Finance works through the concept of capital pools managed by by Pool Delegates.

Crypto investors can deposit their capital into one of these pools, with the Pool Delegate responsible for assessing and approving any potential borrower loan applications.

Once a loan is approved, the borrower can draw down funds from the capital pool. The borrower must then repay the loan with interest over a specified period of time.

Potential Pool Delegates must go through a thorough vetting and application process in order to open a pool on Maple Finance. Once approved, Pool Delegates earn a percentage fee of any profits generated by the pool they manage.

Key Features

- Institutional Borrowing: Maple finance is targeted towards institutional borrowing, allowing major institutions to access unsecured DeFi loans on-chain, whilst giving retail investors the opportunity to invest their stablecoins, including USDC, into a variety of lending pools based on their individual investment preferences. Investorsmust KYC to lend funds on Maple Finance.

- Pool Delegates: Maple Finance enables credit professionals known as ‘Pool Delegates’ to underwrite and manage their respective pools. These Delegates are responsible for negotiating loan terms with borrowers, performing diligence, providing first-loss capital, and liquidating collateral in the event of a default. In return for managing the pool, they receive a 10% performance fee.

- MPL Token: Users can purchase and stake MPL tokens in order to vote on governance decisions, earn a share of protocol fees and perform other actions within the Maple Finance Ecosystem.

Risks/Disadvantages

- Unsecured Lending: Maple Finance is focused on unsecured lending. This creates counterparty default risks. In addition, the flexible withdrawal policy creates a risk that certain lenders will unfairly carry more risk.

- Web3-Focused: Maple finance primarily provides lend towards other Web3 institutions. Unlike many more traditional RWA lending sectors, this carries with it even greater risks. Following the crypto crash of 2022, many Maple Finance loans went sour, with several counterparties such as Genesis Trading defaulting on their debts. In the end, some customers faced losses as high as 80%, with the protocol posting a net-loss in 2022.

- Pool Delegate Centralization Risk: Despite pools being run by credit professionals, there is still a risk of human error when evaluating risk and making lending decisions. Furthermore, pool operation and management is fairly opaque.

Maple Finance’s USDC Yield = 4.8% → 14% APR

The USDC yield on Maple Finance is determined by the terms set out in the pools.

The platform’s various pools offer investors various APYs, ranging from 4.8% on the low-end to 14% on the high end.

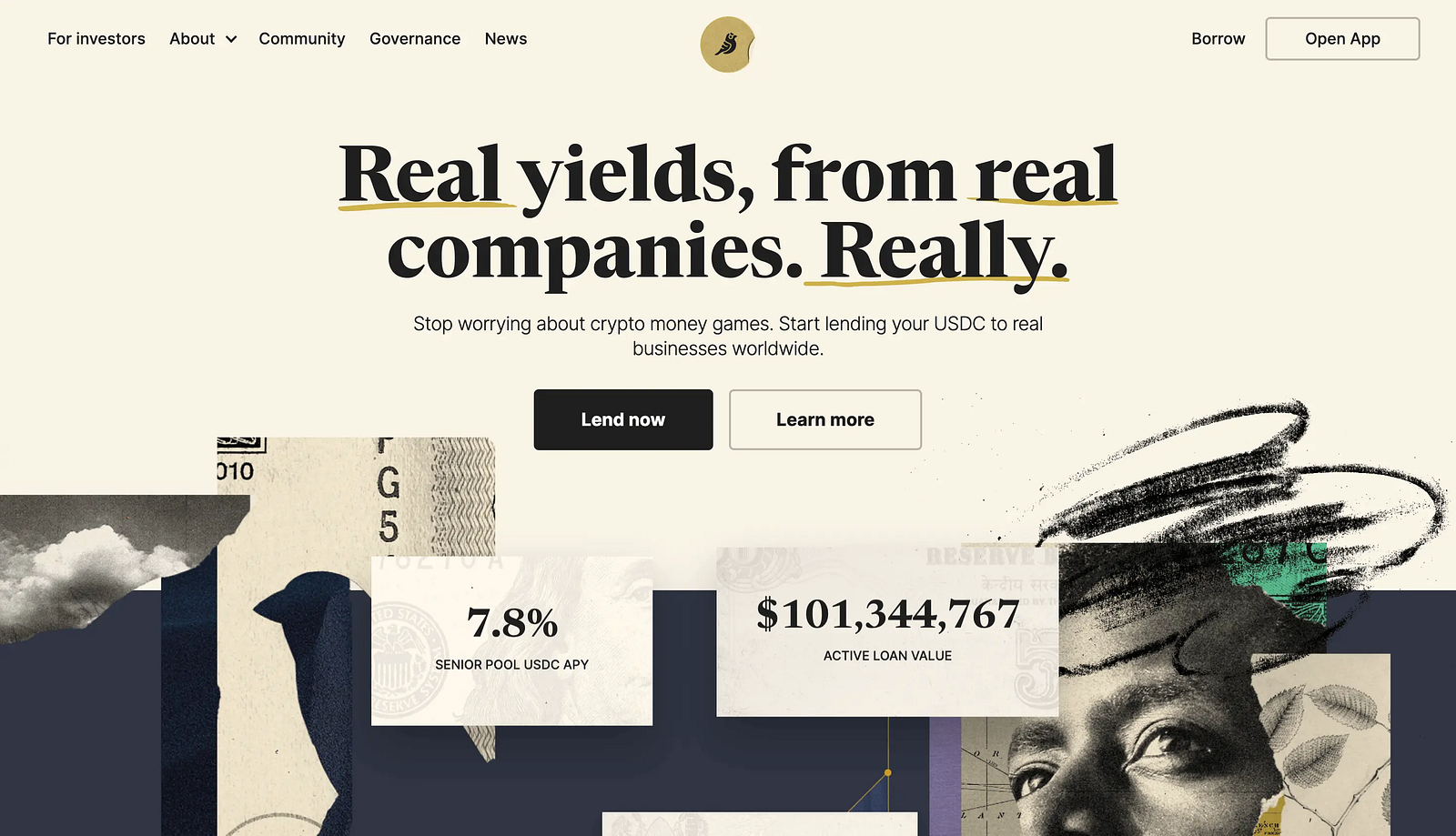

#3: Goldfinch (GFI)

The Goldfinch protocol operates similarly to Gluwa, focusing on lending to real-world businesses, especially those working in emerging market credit.

It functions using a ‘trust through consensus’ mechanism, whereby the community is responsible for assessing and accepting new investment deals.

The Goldfinch protocol currently has three different kinds of members: ‘Borrowers’ are businesses looking to raise funding on the Goldfinch protocol, and who propose ‘Borrower Pools’ to the protocol to be assessed, including interest terms, businesses performance data and more.

At this point, Goldfinch members must assess and decide whether to invest their USDC. ‘Backers’ provide risky, first-loss capital to these specific Borrower Pools in return for higher yields.

Whilst ‘Liquidity Providers’ provide second-loss capital to the ‘Senior Pool’, from which capital is allocated to all successful Borrower Pools — in essence, Liquidity Providers take on less risk and also get less rewards.

Key Features

- Emerging Market Lending: The platform’s investment activities are focused exclusively on lending to real-world businesses in emerging markets. By operating in these high-growth sectors, investors can earn sustainable real-world yields on their USDC whilst hedging their crypto exposure.

- First-Loss vs Senior Pool Lending: The Goldfinch Protocol gives its members significant control over how to invest their funds. Either, they can provide riskier first-loss capital to a specific Borrower Pool of their choice in return for higher yields, or they can invest in the Senior Pool, which automatically assigns less risky second-loss capital to various Borrower Pools in return for lower yields.

- GFI Token: The GFI token is used to perform various functions within the ecosystem, including governance, staking and community grants. Investors can earn GFI by staking their USDC in the Senior Pool.

Risks/Disadvantages

- ‘Secured’ Lending: Although Goldfinch claims all of its loans are over-collateralised and secured by off-chain tangible assets, the truth is that this kind of securitisation isn’t always 100% effective. If a counterparty defaults, it is very likely that Backers and Liquidity Providers may incur some degree of loss.

- Centralization Risks: Currently, Borrower applications are audited and approved by a centralized party. While the protocol has claimed it is implementing a decentralized auditing model, it is unclear exactly how new Borrower Pools are currently approved. Despite the community having the final say over whether to invest, this still creates a risk of bad information, fraud etc. Though, as a reminder, however, this risk is present in almost every DeFi RWA investment platform today.

Goldfinch’s USDC Yield = 7.7% APR

The USDC yield on Goldfinch depends on the terms set by the Borrowers in their respective Borrower Pools.

Depending on the investment deal, borrower Pool rates have varied from around 9% — 18% APY.

The Senior Pool currently offers 7.8% APY.

#4: Centrifuge (CFG)

The Centrifuge blockchain, a parachain of Polkadot, is one of the most disruptive RWA DeFi protocols today.

By tokenizing real world assets into NFTs, and using them as collateral, the DeFi protocol aims to enable collateralized DeFi lending for real world businesses, blending the over-collateralization requirements of decentralized finance with the loan securitization practices commonly found in the traditional finance sector.

The core mechanism underpinning Centrifuge’s lending model is the tokenization of real world assets, such as invoices, real estate, commercial rights etc. into legally wrapped NFTs.

Once a borrower locks up this NFT, they are able to borrow funds from Centrifuge pools against the value of their locked up real world assets, and in accordance with the Centrifuge pool’s interest terms, maturity requirements etc.

On the other hand, KYC’d investors can invest their funds into Centrifuge pools of their choice in order to earn yield. In theory, these investors are protected from default due to Centrifuge’s real-world assets securitization requirement.

Key Features

- RWA Tokenization and Securitization: Centrifuge has a legal mechanism which allows borrowers to being to bring their real-world assets on-chain as NFTs. These NFTs can then be used by the borrower as collateral to secure financing from the protocol.

- Revolving Centrifuge Pools: Centrifuge pools do not work as one-time investment deals. Instead they act as flexible structures, with a decentralized solver mechanism matching investments and redemptions with the available pool liquidity to ensure that borrowers have a constant source of liquidity while investors can flexibly invest and redeem.

- Three-Tiered Investment: Centrifuge pools operate a three-tiered risk yield structure to give users great investment control. Most debt investment operates in the form of ‘tranches’ — basically, which investors get to access the collateral first in case of default. Centrifuge pools offer senior, mezzanine and junior investment tranches. Senior offers the lowest risk and rewards, junior the highest risk and rewards, with mezzanine in the middle.

Risks/Drawbacks

- No USDC support: Centrifuge does not accept USDC on its platform. Instead, investors must convert their funds into DAI — an overcollateralized stablecoin pegged against dollar, but backed by a basket of various decentralized and centralized assets. Whilst converting funds isn’t hard or expensive, it does add another layer of smart contract risk to Centrifuge’s investment offerings.

- Centralization and Last-Mile Risks: Just because a loan is collateralized by real-world assets, doesn’t mean it provides investors with guaranteed protections. For example, users are relying on a centralized party to assess the value of any collateralized assets, which may differ from their actual real world value. Moreover, the liquidation and recovery process can be costly and time-consuming in cases of default. This makes any form of real-world collateralization more expensive and prone to error or centralization failures than on-chain alternatives such as MakerDAO.

- Smart Contract Risks: Centrifuge offers a wide variety of integrations with different DeFi platforms, as well as complex withdrawal and deposit mechanisms to give investors and borrowers more flexibility. Whilst this does unlock new liquidity opportunities, it also exposes the protocol to an increased risk of smart contract vulnerabilities and other exploits.

Centrifuge’s USDC Yield = 4 → 10% APR

The yield on Centrifuge pools depends on the pool and investment tranche chosen.

Currently, senior tranche investment in Centrifuge pools offers between 4–10% fixed APR, whilst junior tranche rates are variable, depending on pool conditions.

#5: Ondo Finance

Ondo Finance is one of the biggest RWA USDC investment platforms today, with over $150M locked on the platform.

Ondo Finance works more similarly to a traditional finance asset management platform, letting users invest their USDC into a range of different ETF funds.

In essence, these are just bog-standard real-world asset ETFs run by centralized intermediaries including BlackRock and Pimco. The only major difference to is that these ETFs accept investment in USDC.

However, there is one big downside to Ondo’s platform: you have to be quite wealthy in order to pass the investing requirements, think $5M+ USD rich, making Ondo finance one of the least accessible DeFi protocols today.

The ETF strategies on offer range from US Treasury bonds, to short-term high grade bonds, to high-yield corporate bonds, with a variety of different risk profiles and yields on offer.

Key Features

- USDC ETFs: Crypto investors can use Ondo Finance to invest in traditional real-world ETFs natively on-chain with USDC. This allows potential investors to diversify their crypto investment portfolio into real-world asset investment classes without having to move their digital assets off-chain.

- Centralized Management: Relies on true-and-tested centralized fund managers to run their investment operations. Fund operators include notorious asset management firms, BlackRock and Pimco.

Risks/Disadvantages

- Limited to Wealthy Customers: Unfortunately, unless you’re a ‘Qualified Purchaser’ (an even more restrictive category than accredited investors) you won’t be eligible to invest on Ondo Finance. Basically, unless you’re worth over $5M USD, forget about it.

- High fees: More centralization naturally comes with higher fees, with annual management and intermediary fees as high as 0.79%.

- Centralization Risks: As Ondo Finance essentially operates a number of centralized ETFs, this comes with all of the standard centralization risks inherent in the traditional financial system. In other words, Ondo Finance ETFs are just your normal Bond ETFs with USDC this time.

Ondo Finance’s USDC Yield = 5%

Depending on the ETF chosen, expected performance/current returns are around 5%.

This is in line with normal traditional finance returns.

#6 Clearpool: Permissionless DeFi lending

Clearpool offers unsecured DeFi lending to a variety of different institutions across both Web3 and traditional real world asset markets. Institutional borrowers can apply to Clearpool, and if accepted, can open a single-borrower pool in order to raise liquidity from DeFi investors in return for interest.

Clearpool operates both permissionless and permissions borrower pools, with only the former being open to non KYCd investors.

Most institutional borrowers on Clearpool’s platform are currently crypto-focused hedge funds and trading firms, with relatively less borrowing institutions operating in traditional real world asset markets such as credit.

In order to be accepted onto Clearpool’s platform, borrowers must integrate with Credora, a privacy preserving zk-proof blockchain, in order to undergo credit risk evaluation, providing investors with a public credit score. 15% of permissionless pool revenue is sent to Credora in return for this service.

Key Features

- Institutional Web3 Lending: Like many popular DeFi protocols, Clearpool offers unsecured lending, primarily to Web3 focused trading desks. These pools also offer the option of flexible withdrawals, provided sufficient liquidity in the pool.

- Credora Integration: Clearpool requires all borrowers to integrate with Credora, a third-party credit evaluation and monitoring blockchain, in order to assess risk and provide investors with additional information and risk analysis. This doesn’t come cheap though, with 15% of permissionless pool revenue sent to Credora in return for this service.

- No KYC Requirement: Clearpool is one of the only decentralized finance protocols that lets you invest in real world assets without requiring KYC. Whilst this depends on the pool and borrower, and could very well change in the future due to regulatory requirements, it definitely sets it apart from other DeFi protocols today.

Risks/Drawbacks

- Unsecured Lending: Like many decentralized finance platforms working in traditional finance, Clearpool only offers unsecured lending, greatly increasing the risk of investor losses in cases of borrower default. Clearpool does offer a third-party integration on its platform via IdleFinance, allowing investors to access risk diversification options with senior and junior tranche lending.

- Web3 Focused: Similarly to MapleFinance, the vast majority of institutional borrowers on Clearpool are focused on crypto trading and Web3. This is an inherently high-risk high-return industry, and therefore the risk of borrower default may be higher than other more traditional financial sectors.

- Credora, Opaque and Expensive: Despite giving investor’s some limited degree of extra transparency, Credora’s risk evaluation strategies and decisions are largely opaque, with investors having limited access to counterparty performance information. In addition, Credora charges a permissionless pool revenue fee of 15% for this service.

Clearpool’s USDC Yield = 3 → 21%

With the focus on Web3 firms, Clearpools RWA investment pools do offer a very respectable 3 → 21% APY.

What are Real World Assets?

Real-world assets, or RWAs for short, are simply traditional real-world financial assets. They can refer to assets such as property, bonds, commodities, stocks, shares and more. This is in contrast to the relatively new world of ‘online-only’ digital assets such a Bitcoin, Ethereum, NFTs and the various other DeFi protocols and tokens.

Today, the term RWAs is used to describe the increasing digitization of traditional financial markets on the blockchain. In other words, the growing convergence between real-world of traditional finance and the digital-only world of blockchain. By connecting real world assets to various DeFi protocols, these capital markets are becoming more accessible, efficient and in some cases, secure, than their traditional financial counterparts. Let’s explain more…

DeFi Protocols and RWA Investment

Many DeFi protocols are focused on delivering on-chain RWA investment opportunities directly to investors, offering both borrowers and investors several advantages:

- New high-yield investment opportunities: Many traditional investment markets today are closed to smaller investors. Today, there are many top DeFi protocols which are democratizing access to various investment markets, including bonds, equity, and more, allowing investors to receive higher yields (in return for higher risks.)

- Increased liquidity: DeFi can provide increased liquidity for real world industries, with DeFi protocols enabling 24/7 trade, fundraising, asset fractionalization and automated smart contract management.

- Lower costs: Unlike centralized financial systems, DeFi protocols require less (or even no) intermediaries, such as banks or brokers, saving investors money on fees and commissions.

- Greater transparency: Decentralized finance can provide greater transparency in real world asset markets, with on-chain transparency increasing investor confidence, counterparty trust and reducing fraud.

- More security: In principal, smart contracts can enforce strict asset management mechanisms to protect investor’s capital. However, this isn’t always the case due to the risk of smart contract exploits.

What are the risks?

However, it’s important to remember that investing in the RWA DeFi ecosystem also carries with it significant risks. Whilst many of the most popular DeFi protocols today are successfully democratising real world assets, they also face systemic risk exposure from both traditional and on-chain risk vectors.

- Centralization: Despite operating on the boundary of Defi and Tradfi, every one of the protocols in this article still operates around some kind of centralization. Primarily, in the selection, auditing and offering of new borrower pools and investment opportunities. In other words, while still you get to choose who you want invest in, can you always trust the platform to offer you the right opportunities?

- Default Risks: These protocols often face the risk of borrower default. You should be aware of the exact policies each protocol has in place to reduce and mitigate this risk. While several of these protocols offer some form of securitization and investment tranche selection, remember that your funds will always be at risk, and even securitised debt can result in investor losses.

- Smart Contract Risks: Like anything in decentralized finance, the risk of smart contract exploits is ever present. Unlike traditional finance, there may be no way for users to recover lost funds in the case of a protocol exploit, bug or hack.

As long as you keep these key vulnerabilities in mind, remember to do your own research, and carefully consider the very real risks inherent in each of the protocols discussed today, then you’re already better equipped than most.

Please remember that this article is intended for informational purposes only and is not intended to be investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Concluding Thoughts

The fusion of Real-World Assets (RWA) with DeFi has opened up new vistas for investors to generate substantial USDC yield.

Platforms like Gluwa, Maple Finance, Goldfinch, Centrifuge, and Clearpool are pioneering this space, with these exciting new investment platforms offering a range of incredible yields and opportunities for the savvy DeFi investor.

However, while these platforms offer lucrative opportunities, it’s imperative for potential investors to undertake thorough research and due diligence before investing.

Each platform carries its own risks. Risks which you, as an investor, must always undertake to fully understand and evaluate.

The key to successful investing lies in understanding these risks and aligning them with your overall investment strategy.

To be clear, ALL of these platforms are likely more risky than many of their traditional finance counterparts. Of course, they’re probably more rewarding too.

This article is intended for informational purposes only. It is not intended to be investment advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Updated by Joshua Yap & Toby Bromet on October 3rd, 2023.