2.0+ Explained | Nominated Proof of Stake & Tokenomics

A lot is changing with 2.0+. Read this guide for everything you need to know better.

A lot is changing with 2.0+. Read this guide for everything you need to know.

We’re making some big changes to Creditcoin with the upcoming 2.0+ update, expected to release in Q3 of this year. The network will be transitioning into a Nominated Proof of Stake (NPoS) consensus model, and there are tokenomics updates going on under the hood too. In today’s article, we’ll explain everything you need to know about what’s changing with Creditcoin 2.0+.

Nominated Proof of Stake

What’s Happening?

We’ve often talked about the possibility of transitioning to another consensus model if and when the advantages became worth it.

In 2017, this was not the case. PoS was still a novel and unproven technology. Today, PoS is considered the golden standard for most blockchain networks, with Ethereum’s successful move to PoS confirming our belief that the time has come to make the transition.

In fact, PoS systems have significantly matured and developed since then, with various new implementations already live. Most notably, Nominated Proof of Stake has seen adoption by a number of L1 chains, including Polkadot, Cosmos and more. After the 2.0+ update, Creditcoin will become a fully Nominated Proof of Stake network.

What is Proof of Stake?

Consensus algorithms are used to validate new transactions in decentralized networks, ensuring the security of the network by assigning winning validators and handing out rewards. The most famous consensus algorithm is Proof of Work.

In Proof of Work, miners must complete computationally expensive tasks in order to validate new blocks and earn rewards. The more mining power you have, the more likely you are to win.

Proof of Stake works similarly, but instead of computational power being needed to win, PoS relies on users ‘staking’ their funds. In other words, by locking up funds, stakers have a chance to validate the next block and earn rewards. The more you stake, the more CTC you win.

Dishonest behaviour is economically disincentivised through the risk of slashing a user’s staked funds. In other words, stakers lose money every time they participate in malicious or negligent behaviour.

What's the difference between PoS and NPoS?

Creditcoin's Nominated Proof of Stake (NPoS) is a variation of the Proof of Stake (PoS) consensus algorithm, maintaining the same cryptographic principles and economic incentives to achieve network security.

NPoS introduces a nominator-validator model where nominators can select and vote for any number of validators to be elected using staked CTC. Nominators delegate their staked CTC to validators via voting, and in return, they can receive a share of backed validator's rewards. Once elected to the active set, validators are responsible for validating new blocks and earn CTC rewards.

NPoS two network consensus roles are summarized below:

🖥️ Validators - Responsible for running a node and validating blocks. Must be elected into the 'active set' via nominator voting. Requires technical expertise and dedicated hardware. More Rewards.

🗳️ Nominators - Responsible for backing honest validators. Stake CTC to vote and elect validators to the 'active set'. Requires minimal technical expertise and no dedicated hardware. Lower Rewards.

This system allows token holders, who may not have enough stake or technical expertise to become a validator, to nonetheless participate in the network and earn rewards by supporting trusted validators instead. This helps the protocol achieve greater decentralization and staking accesibility.

In traditional PoS, validator's network validaton power is also equivalent to their total network stake. This can result in staking power centralization, raising the risk of bad behaviour and coordination attacks. In NPoS, power is distributed equally between all validators in the active set, regardless of total backed CTC. This system makes it harder for malicious actors to coordinate network attacks in Creditcoin's NPoS implementation vs PoS.

What are the advantages of Proof of Stake?

🔒 Security: Consensus algorithms work by imposing economic costs on would-be attackers. Smaller PoW networks are particularly vulnerable to 51% attacks. This is because mining power is highly mobile, making it feasible for attackers to target different networks without facing significant costs.

Staked assets are much less mobile. By forcing would-be attackers to control over 51% of the total staked CTC supply, PoS makes such an attack on Creditcoin economically self-defeating.

🤝 Incentive Alignment: In PoW, miners are incentivised purely by financial rewards, and can easily migrate their mining power to other networks, almost like mercenaries for hire. Ultimately, this means that miners don’t always have the best interests of the network in mind.

In PoS, Creditcoin users will be incentivized to hold onto their CTC and stake it to earn rewards. By locking up their assets, validators in PoS have a stronger vested interest in the network’s success and are therefore more likely to act in the network’s and its users’ best interests. If a staker acts badly, the underlying value of his staked tokens will directly go down.

⛓️ Network Scalability: PoS is considerably more energy efficient than PoW, which requires extensive computational power to maintain. This has advantages when it comes to scalability. By using PoS, Creditcoin will be able to achieve faster block times, handle more transactions, and make those transactions cheaper — a very useful feature for fintechs recording thousands of loans every day.

🌌 Decentralization & Accessibility: Compared to mining, which requires specialised hardware, partaking in PoS validation is far more accessible for most people. All you really need is some CTC and an internet connection. That means more people can help to secure the network, increasing our network effects and sharing the spoils of validation more fairly across Creditcoin’s various stakeholders.

🌿 Environmental Impact: Another benefit of PoS is the great outdoors. PoW requires miners to solve energy-intensive computational problems. Alternatively, running a node in PoS requires a fraction of the computational power, which means less energy spent on validating transactions. This can both lower costs for validators and reduce the environmental impact of Creditcoin!

🧑⚖️ Regulatory Compliance: Whilst not an immediate concern, some regulators, for example in the European Union, have considered banning PoW in favour of PoS. Just recently the US also imposed a 30% tax on crypto mining citing electricity concerns. By moving to PoS, Creditcoin will be better prepared for any potential shifts in the regulatory landscape.

Tokenomics

Given the switch over to Proof of Stake, we’ll also be changing the Tokenomics model in order to best take advantage of future ecosystem growth. That means we’re implementing a number of key changes:

⏰ Block Time: 60 seconds → 15 seconds

⛏️ Block Rewards: 28 CTC → 2 CTC

Block Time Reduction

As part of our transition to PoS, we’ll be introducing lower block times for Creditcoin. Currently, the target is to reduce average block times from around 60 seconds to every 15 seconds.

By reducing block times, we’ll be able to increase the number of transactions which Creditcoin can handle, an important step in delivering better blockchain performance for our fintech partners recording thousands of real-world loans every day.

Block Reward Reduction

A natural byproduct of faster block times is also reduced block rewards. We’re planning to reduce block rewards from 28 CTC to a fixed reward of 2 CTC. This may sound like a dramatic decrease, however, there are a few points to note.

Whilst this does reduce rewards in the short term, an issuance of roughly 8 CTC per minute actually equates to better long-term rewards for CTC validators, especially when you take in the reduced energy consumption costs of PoS.

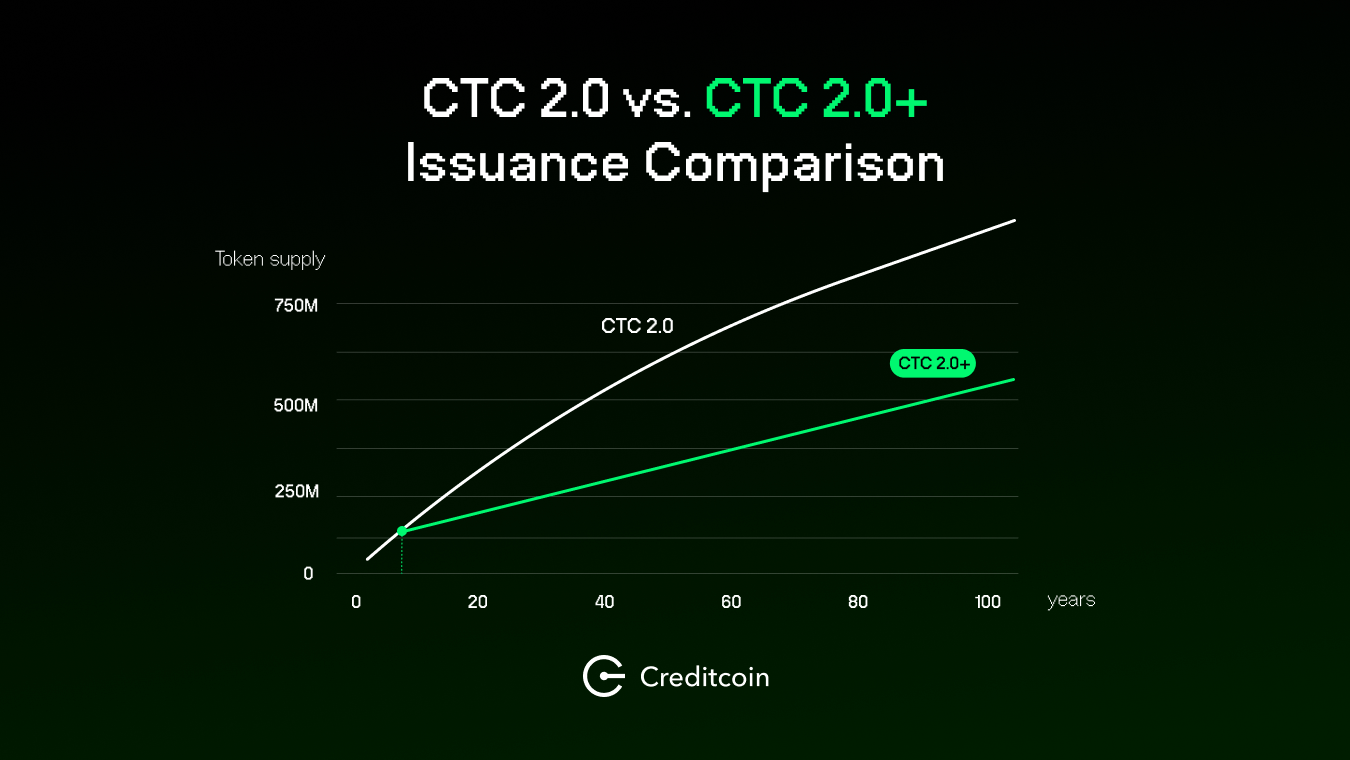

By reducing the total CTC issuance rate, 2.0+ also significantly reduces CTC supply inflation. Following 2.0+, only 4.2M will be supplied annually, versus 14.7M CTC currently — a reduction of 71.4%. You can see the effect of this in the graph below.

At the new issuance rate, it’ll take ~300 years to reach the previous maximum supply. When you add transaction fee burning to the mix, Creditcoin 2.0+ will actually have less inflationary pressure than before, putting the reward schedule on a more sustainable long-term footing.

Finally, but perhaps most importantly, it also means rewards are distributed between more people. By increasing the number of blocks, we’ll be smoothing out the reward curve, making smaller stakers more likely to win validation rights and therefore earn rewards. You might not win as much, but you’re more likely to win, helping us make Creditcoin staking more accessible, fair, and decentralized. By encouraging more nodes to take part in network validation, we’ll be making Creditcoin 2.0+ the most secure implementation of Creditcoin there’s ever been.

Closing Remarks

As you can see, there are lots of exciting updates in the pipeline for Creditcoin to revamp the network, making it more accessible, secure, and efficient than ever before. We’d love to hear all your feedback on the next major Creditcoin update in our Discord community!

Plus, we’ll be hosting a live community Q&A to discuss this latest update and address all your questions — follow our Twitter for more.

Whilst the transition to proof-of-stake and revised Tokenomics are all a pretty big deal in and of themselves, in truth, they’re just the first steps towards an even bigger and better overhaul coming to the Creditcoin Network. We’ll be sharing more information about our long-term plans for the next generation of Creditcoin in the following weeks and months.

About Creditcoin

Creditcoin is a foundational L1 blockchain designed to match and record credit transactions, creating a public ledger of credit history and loan performance and paving the way for a new generation of interoperable cross-chain credit markets.

By working with technology partners, fintech lenders such as Aella, and other financial institutions across global emerging markets, Creditcoin is securing capital financing, building credit history and facilitating trust for millions of underserved financial customers and businesses based on the principles of Real World Assets (RWAs).

Website | Twitter | Discord | Medium | Youtube | Telegram(ANN) | Telegram(Community) | Whitepaper(ENG) | Opensea