Universal Smart Contracts: Build Trustless Cross-Chain dApps on Creditcoin Testnet

Cross-chain development currently forces you to choose between security and functionality. Traditional cross-chain data access relies on centralized oracles that become single points of failure and trust. Meanwhile, your smart contracts remain blind to transaction histories from other chains, forcing you to build isolated systems and move assets between them.

Creditcoin's Universal Smart Contracts (USC) eliminate this compromise. Now live on testnet, USC creates a smart contracts hub connected to other blockchains, powered by a decentralized oracle that enables your contracts to query and verify transaction data from any blockchain through cryptographic proofs.

Click play to watch the USC intro video

The Problems USC Solves

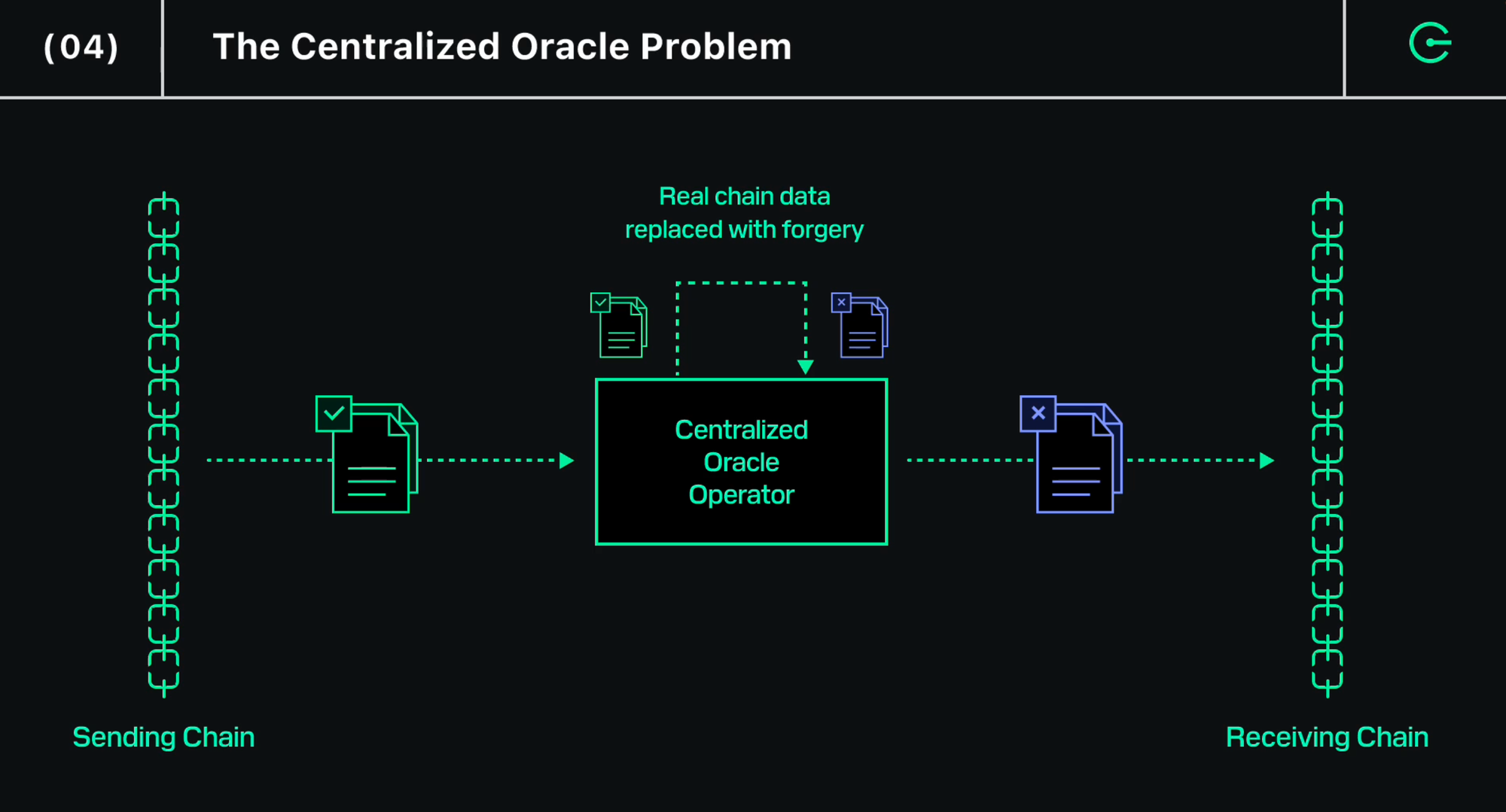

The Centralized Oracle Problem

Current cross-chain solutions rely on centralized oracle operators who can manipulate data or become compromised. When your smart contract needs to verify that a transaction happened on Ethereum, you're forced to trust that the oracle is providing accurate information. This creates a fundamental security weakness; even if the underlying blockchains are secure, your application's security depends on trusting a centralized intermediary.

Bridge Security Exploits

Every traditional bridge introduces attack vectors through trusted validator sets or multisig schemes. Users deposit funds trusting that these centralized components won't be compromised. However, the track record speaks for itself, with billions lost to bridge exploits over the years.

Limited Cross-Chain Data Access

Smart contracts need transaction histories to make informed decisions, but accessing data from other chains typically requires:

- Oracles with trusted data feeds

- Manual verification processes

- Complex off-chain infrastructure

- Accepting reduced security guarantees

Development Complexity

Building cross-chain functionality means managing multiple SDKs, understanding different consensus mechanisms, and coordinating between incompatible systems. Simple concepts like "verify this payment happened on Ethereum" become major engineering undertakings.

USC's Core Attributes

USC addresses these challenges through three key mechanisms:

Trustless Verification: Cryptographic proofs replace the need for trusted intermediaries. Your smart contract can verify that a transaction occurred on another blockchain with mathematical certainty.

Universal Compatibility: Query transaction data from any blockchain: Ethereum, Solana, Bitcoin, or any network with a verifiable transaction history.

Developer Simplicity: Submit queries through standard Solidity interfaces. The underlying cryptographic complexity is abstracted away.

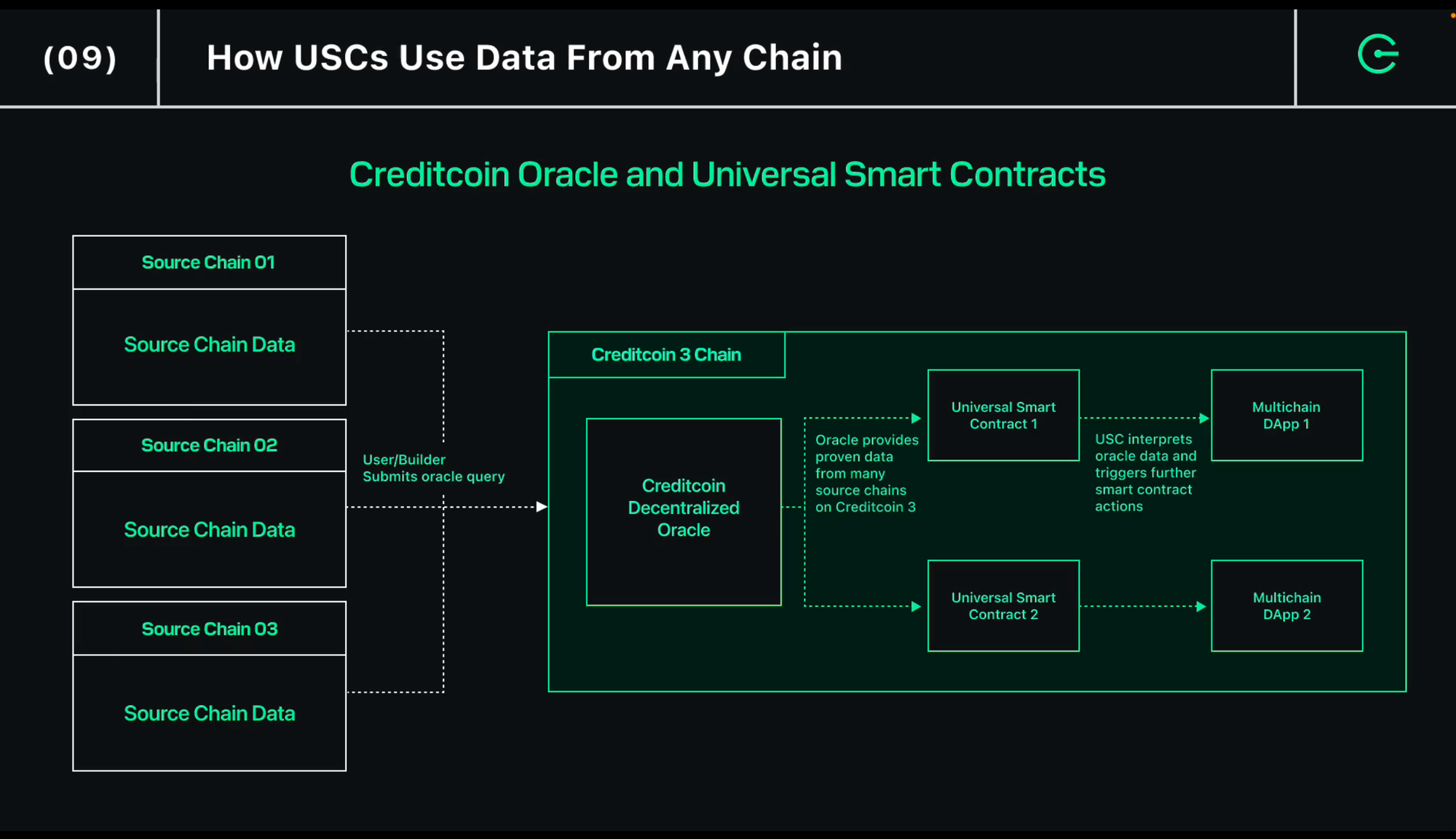

How Universal Smart Contracts Work

A Universal Smart Contract is a contract that lives on Creditcoin but can read and use data from any integrated blockchain. It's capable of processing information provided by Creditcoin's decentralized oracle network, making your smart contracts dramatically more powerful because multiple chains become usable in one place.

The key difference lies in how cross-chain data verification works:

Current Approach: Centralized Oracle. Your smart contract must trust a single oracle operator to provide accurate cross-chain data. If that operator is compromised or provides false information, your entire application becomes vulnerable.

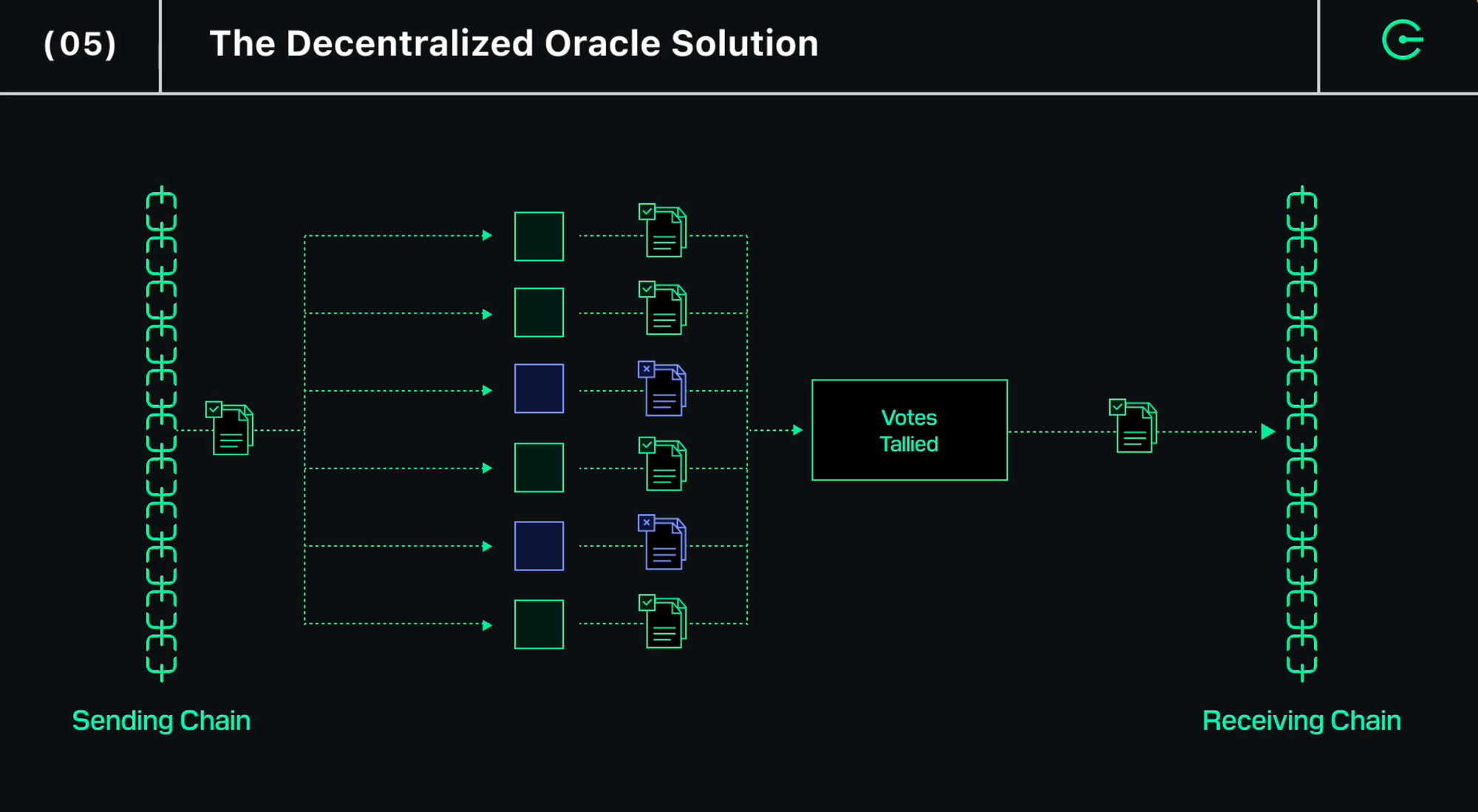

Our Approach: USC Decentralized Oracle. Multiple independent attestors reach consensus on blockchain transaction histories, creating cryptographic commitments that any prover can use to generate verifiable proofs. Your smart contract receives mathematically verifiable truth rather than trusted assertions.

The USC architecture relies on two key components:

Attestors continuously build consensus on source blockchain transaction histories, creating cryptographic summaries (attestation chains) that serve as canonical references.

Provers generate STARK proofs that specific data exists within those attested histories. When your smart contract needs external blockchain data, provers compete to fulfill your query with verifiable proofs.

This creates a decentralized system where your smart contract can verify cross-chain data using cryptographic proofs rather than trusting any centralized party.

USC Use Case: Cross-Chain Loan Repayment Verification

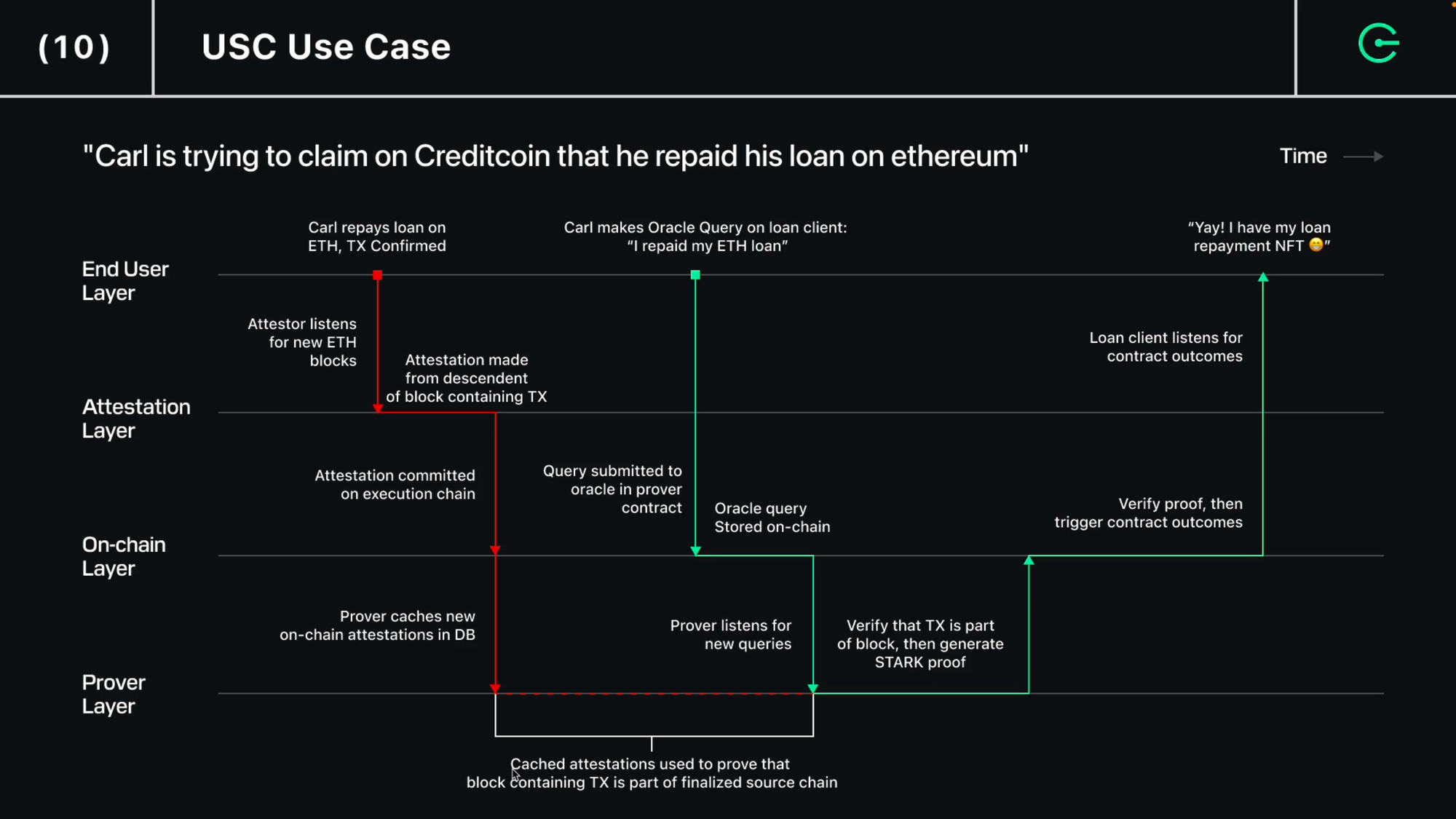

Here's how USC works in practice with a concrete example. Carl wants to claim on Creditcoin that he repaid his loan on Ethereum:

- Loan Repayment: Carl repays his loan on Ethereum, creating a verifiable transaction

- Attestation Process: Attestors continuously monitor Ethereum, building consensus on its transaction history

- Oracle Query: Carl makes a query claiming, "I repaid my ETH loan."

- Proof Generation: A prover verifies that Carl's repayment transaction exists in the attested Ethereum history and generates a cryptographic proof

- Verification & Execution: The USC verifies the proof against Creditcoin's decentralized oracle and triggers the appropriate contract outcomes (like minting a loan repayment NFT)

This repayment NFT serves as a cross-chain verifiable truth via mathematical proofs that Carl fulfilled his loan obligations, enabling him to access new credit opportunities, release/reclaim collateral, and build a stronger on-chain reputation, all without trusting any centralized intermediary.

🏁 USC Action Checkpoint #1: Trustless Bridge

For this USC testnet, developers can explore how our architecture enables secure cross-chain asset transfers without traditional bridge vulnerabilities. Our testnet includes a working bridge between Sepolia and Creditcoin that demonstrates:

- Token Burn: User burns tokens on Sepolia

- Event Detection: Query builder monitors Sepolia and detects the burn event

- Bridging Request: Bridging request gets submitted to Creditcoin

- Proof Generation: Provers generate a cryptographic proof of the burn transaction

- Verification & Minting: USC verifies the proof against the attestation chain and mints equivalent tokens on Creditcoin

The critical difference from traditional bridges: no trusted validators, multisig schemes, or central points of attack. USC’s trustless bridge relies entirely on cryptographic proofs verified by the decentralized attestation network, which is a significant upgrade from the market’s current solutions.

Universal Credit: Aggregate Financial Behavior Across Chains

USC's real power emerges when you consider applications beyond token transfers. For the first time, smart contracts can build comprehensive views of user behavior across the entire blockchain ecosystem.

Let’s take the scenario of a typical defi lending protocol. When you’re building on one network, you have fragmented credit and identity systems.

For example, your lending dApp on Ethereum can't see a user's repayment history on Polygon.

Or an identity platform built on Solana starts from zero when users interact on Arbitrum.

Each chain becomes an isolated island, forcing users to rebuild their reputation and developers to implement workarounds.

However, with USC, your lending protocol can verify:

- Successful loan repayments on Ethereum

- Liquidity provision history on Polygon

- Trading behavior on Solana

- Collateral management on Arbitrum

Instead of treating each user as a blank slate, your protocol can make risk assessments based on their complete on-chain financial history. This enables:

For Users:

- Lower collateral requirements based on proven repayment history

- Portable reputation that works across all chains

- Access to better rates by leveraging their full activity history

For Developers:

- More sophisticated risk models using cross-chain data

- Reduced default rates through better underwriting

- New product categories like under-collateralized lending

🏁 USC Action Checkpoint #2: Credit Verification dApp

Our second USC testnet dApp demonstrates how users can repay loans on Sepolia, then prove that repayment to mint credit verification NFTs on Creditcoin. The process:

- User repays loan on Sepolia

- User submits a repayment claim to the USC

- Provers generate proof of the repayment transaction

- USC validates the proof and mints a credit record NFT

This creates verifiable, cross-chain credit history that any protocol can reference.

Let’s Build Together

USC testnet is live with both bridge and loan verification examples. These demonstrate fundamental patterns you can adapt for your own applications. Get creative, don’t settle, and realize that it is time to eliminate trusted intermediaries from your cross-chain architecture!

Get started with USC:

And for the non-devs who made it this far, we're glad you took the time to explore the future of cross-chain dApps - it’s time for your reward! If you’re participating in any of the airdrops on Penguinbase right now, copy and paste the event codes below to claim your 30 points!