RWA Recap | Jan 2023

This month in RWA: Investor DAO, over $70M recorded, Circle Partnership and more.

This month in RWA: Investor DAO, over $70M recorded, Circle Partnership and more!

It’s been a very busy month for us here at Gluwa and Creditcoin! Above all else, we’re super excited to have finally shared the new Investor DAO with all of you, including the launch of our first Investment Opportunity with Jenfi, which reached 200% of our investment target in under two weeks! A huge thank you to everyone who took part 🙌

If you missed out, don’t worry, we have lots more exciting opportunities coming soon! You can sign up for our mailing list here to get notified as soon as they go live.

📔 Check out our complete 2022 Real World Assets (RWAs) recap here, showcasing all of the biggest stories from 2022.

📣 PSA: for everyone using Gluwa Invest, we dropped a little community update outlining some upcoming changes which may affect you. Check it out here.

Creditcoin

$70M Aella loans recorded

That’s right. In a recent tweet, Aella CEO, Akin Jones, announced that Aella had recorded over $70M loans on the Creditcoin blockchain in less than a year! Here’s to an even bigger 2023 for Aella 🥂

Creditcoin Summary 2022

2022 was great year — we built an entire new foundation for Creditcoin, got listed on tonnes of new exchanges, including Kucoin, Huobi and ByBit, and secured a raft of new partnerships, including Tron, Polygon, Stacks. Check out our quick summary of all of the biggest Creditcoin milestones in 2022, including Credal, Creditcoin 2.0 and more.

Welcome to the team — Tannr Allard

We’re very excited to welcome a big new member to the Creditcoin team. Tannr Allard is joining as our new Director of Blockchain Engineering, having previously worked at MakerDAO! He’ll be spearheading our efforts to iterate and improve Creditcoin to the next level. Check out some quick answers from our conversation with him here.

RWA Q&A | January

Want to know why we built the new Investor DAO, or how it might change CTC staking (spoiler alert, it doesn’t), then check out our latest monthly Q&A.

5M $CTC Deposited with @BinanceCustody

The Creditcoin Foundation announced a transfer of 5M $CTC to Binance Custody for safe keeping.

Gluwa

Investor DAO Launch

By far the biggest highlight of January was the launch of our much-anticipated Investor DAO, letting users almost anywhere in the world partake in real-world asset investing! You can access Investor DAO through the Gluwa App today.

Download links: 🍏 Apple | 🤖 Android

Investor DAO democratizes global investment whilst putting you in the driver’s seat, with full control over where your money goes, unrivaled investment transparency, a minimum investment size of only $1 USDC, and decentralized governance in the pipeline.

Check out our Investor DAO Introduction to learn more…

Investor DAO Jenfi #1

Launching alongside the new Investor DAO, Jenfi #1 was our first Investment Opportunity for DAO members, offering a spicy 19.04% APR to investors. Jenfi are a rapidly growing debt financing company for online businesses across SE Asia.

If you’re reading this, then sadly you’ve already missed the chance to invest, with Jenfi #1 securing an investment of 500k USDC in less than two weeks (double the funding target)! But, fret not, we have lots more opportunities like this coming over the following months. Make sure you sign up for our mailing list here to hear as soon as they go live.

Investor DAO | Signup & KYC Guide

Interesting in joining the Investor DAO to start earning up to 20% APR on real-world asset investments? Luckily for you, we made a quick Signup Guide to walk you through the process.

Investor DAO | Investment Guide

Once you’ve joined the Investor DAO you’ll be able to make your first investment. Check out our complete guide to the investment process here. TLDR: Get some USDC and ETH, read the Heads of Terms, Approve and then Invest!

Gluwa Capital x Circle

Gluwa Capital partnered with Circle, the world’s most trusted stable coin provider and issuer of USDC, to build our investment operations on USDC, helping to connect highly liquid crypto capital to emerging market investment opportunities.

Gluwa Summary 2022

See what we got up to in 2022 at a glance, including the Lottery and Bond Account launches, tonnes of new RWA partnerships and more…

Lottery Account Migration — Deposits Suspended

In preparation for our upcoming chain migration, we suspended Lottery Account deposits. Read our recent Gluwa Invest Community Update for a brief summary of all the upcoming changes coming to Gluwa Invest.

Lottery Account Events

As usual, we hosted a variety of exciting events for our Lottery Account investors! Even though we’re migrating the account to a new chain, we’ll continue to hold more Lottery Account events over the coming months.

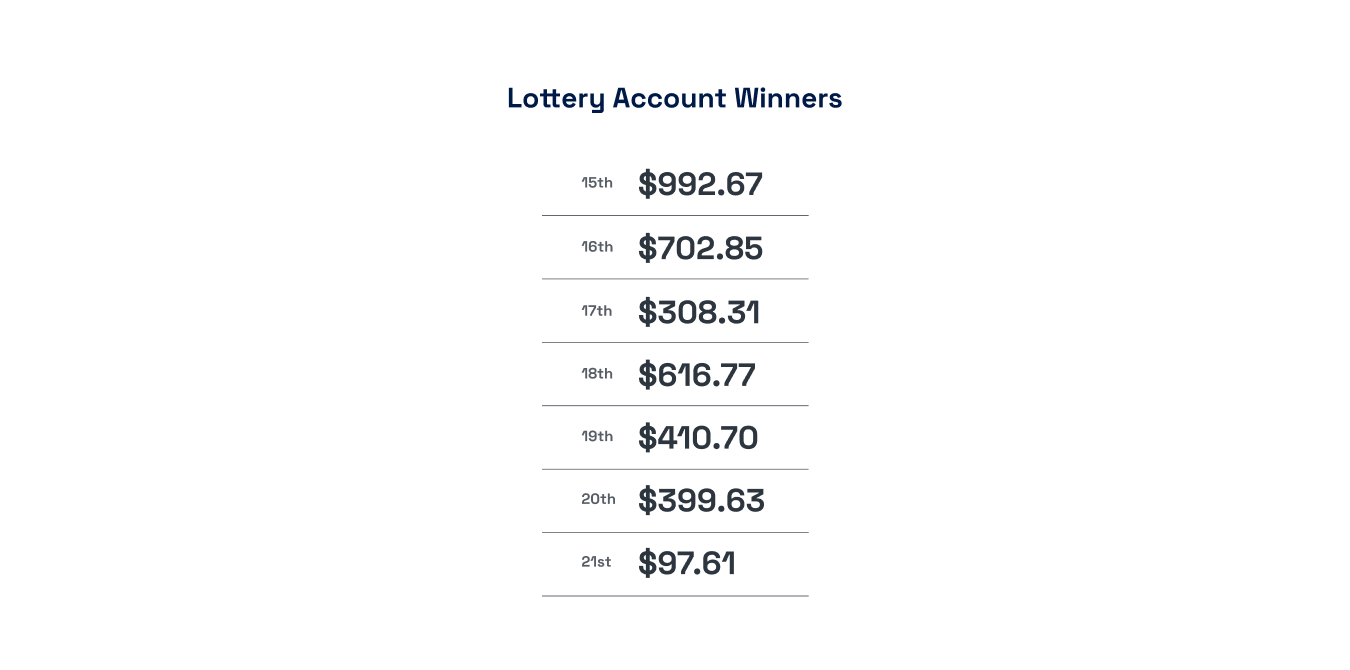

Lottery Account Winners

We had a total of SEVEN different winners this January, our highest record yet. Congratulations to everyone who won!

Gluwa hiring for South Korean PM position

P.S we’re hiring for a new PM position based in South Korea. Think you’d be a great fit? Check out the ad here.

That’s it for January folks, see you all next month!

Download the Gluwa App to join RWA today: 🍏 Apple | 🤖 Android

About Creditcoin

Creditcoin is a foundational L1 blockchain designed to match and record credit transactions, creating a public ledger of credit history and loan performance and paving the way for a new generation of interoperable cross-chain credit markets.

By working with technology partners, fintech lenders such as Aella, and other financial institutions across global emerging markets, Creditcoin is securing capital financing, building credit history and facilitating trust for millions of underserved financial customers and businesses based on the principles of RWA.

Website|Twitter|Discord|Medium|Youtube|Telegram(ANN)|Telegram(Community)|Whitepaper(ENG)|Opensea

About Gluwa

Gluwa is an RWA platform, connecting capital from developed markets to emerging market lending opportunities using blockchain technology. By providing the decentralized infrastructure rails to raise and disburse capital anywhere in the world, investors can use the Gluwa Investplatform to partake in debt-financing deals with emerging market fintech lenders, earning up to 20% APR.

Website|Twitter|Medium|Youtube|Instagram|Discord|Github|Opensea