Proposing Creditcoin 3.0

Creditcoin 3.0 proposal is here and here's what it is about.

One year ago, we proposed Creditcoin 2.0, a major protocol upgrade designed to help Creditcoin deliver the scalability and technical performance required for real-world applications.

Today, Creditcoin has recorded over 3 million real-world transactions, collectively worth well over $70M USD. This incredible milestone marks the success of Creditcoin 2.0 as the first working version of the protocol. I am both proud, but even moreso, excited for what’s to come.

We now have a fully functioning, interoperable, credit network, decentralized across over one thousand unique validators. With the recent release of the Investor DAO, we also have a working on-chain credit market open to investors around the world. Together, we have the two ingredients we need to deliver a truly borderless, global credit network.

There are now two paths open to us: steady iteration or true evolution. We know that iteration will never be enough to reach our full potential. And so, I’m excited to share our vision for the next generation of Creditcoin with you today.

The State of Play

Crypto is radically different from what it was just a handful of years ago. There are now dozens of L1s, each with its own composable ecosystems of protocols, dApps, marketplaces and more. Yet despite remarkable leaps in local interoperability, L1 protocols remain largely siloed from each other, stifling cross-chain innovation, competition, and most importantly, usability.

In 2023, one thing is very clear: the future is multi-chain. Just as in Web2, where no single website, browser, or platform has truly monopolized the web, we expect Web3 to be composed of multiple blockchains connected to each other, serving different roles within the wider ecosystem according to their respective user advantages.

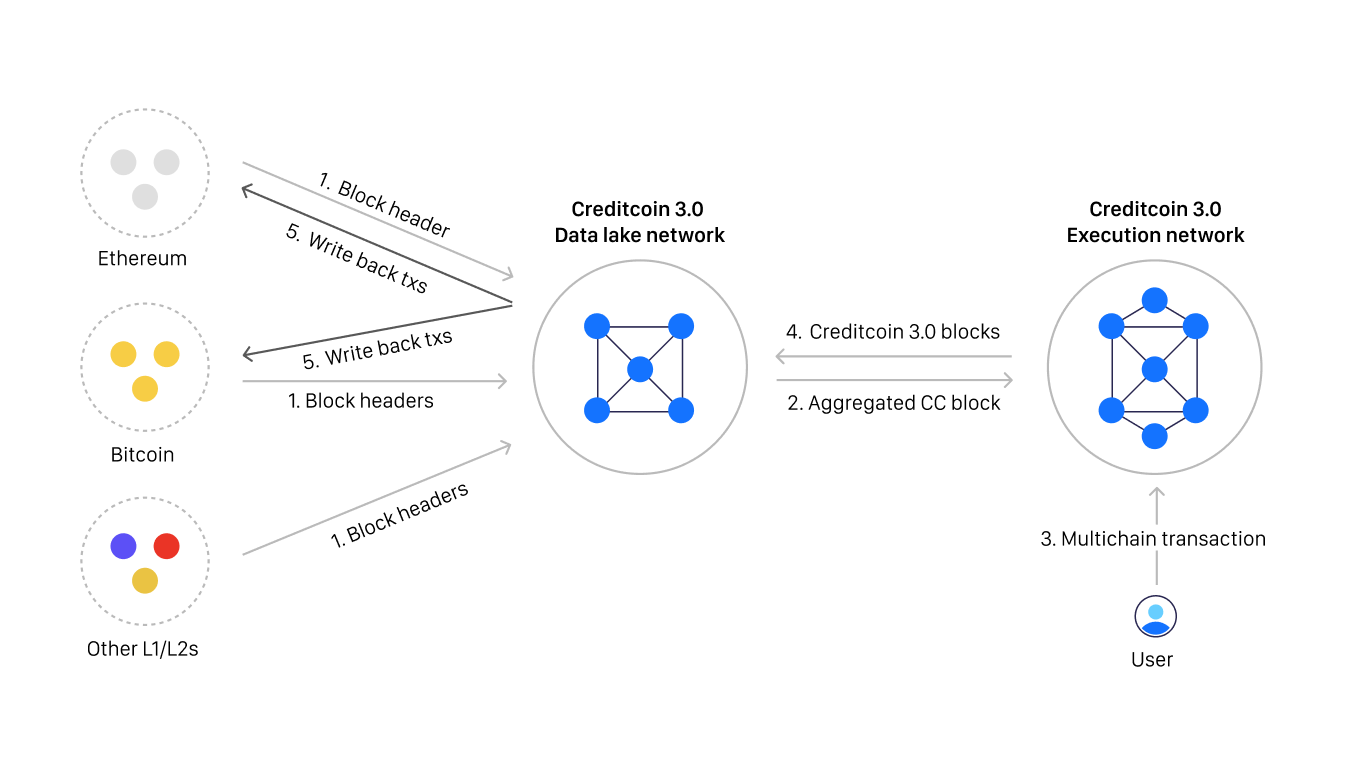

Creditcoin was always designed for a multi-chain future; it is interoperable by design, verifying, and recording loan transactions that happen on other chains. Currently, Creditcoin has a built-in, one-way oracle, allowing it to read information on other chains in order to register new wallets, verify loan transactions, and ultimately, aggregate on-chain credit history. However, this method was limited to just simplistic verification of loan transactions.

That changes with Creditcoin 3.0.

Creditcoin 3.0 — The Universal Smart Contract Layer of Web3

Looking to the future, we know we can do so much more with the technology we’ve built. Most importantly, something entirely new to this space. I propose evolving Creditcoin from a read-only credit network into a fully EVM-compatible layer 1 blockchain network that is interoperable across multiple chains. Allow me to elaborate.

Since day 1, we’ve designed Creditcoin with a built-in oracle. In other words, a bridge between a blockchain and its external environment, allowing it to access external data which can then be used and integrated into its own chain for various purposes.

Creditcoin already uses an oracle to track loan activities on other blockchains, collecting and aggregating credit history across multiple chains, giving context to related transfers, and building credit for the end-users.

Today, we only use this oracle to verify loan transactions, but why stop there? We can use this oracle to validate any information on another network, such as transactions, block data, and even the state of L1 chains.

By combining a built-in generic oracle with an EVM-compatible blockchain, Creditcoin 3.0, or CC3, can enable entirely novel use cases, and above all, present the game-changing innovation of universal smart contracts.

For simplicity’s sake, you can analogize Creditcoin 3.0 to the Zapier of the Web3 world.

For example, if X debt is paid back on Ethereum, release collateral Y on BNB Chain.

With universal smart contracts, we can remove the inherent silos that exist around every chain’s ecosystem. This enables developers to build multi-chain applications without the risks and complexity that accompany cross-chain technology today (and is often more centralized than we would like). We can enable further decentralization of centralized services in Web3, such as exchanges and mining pools, and build new, composable tools which integrate across various on-chain and off-chain ecosystems.

The undiscovered use cases and the myriad of possibilities excite me!

Let’s dive deeper into the key proposals for Creditcoin 3.0 below.

Creditcoin 3.0 Key Changes

EVM-Compatible Chain

The biggest change: I propose turning Creditcoin into a fully EVM-compatible layer 1 blockchain. This means anyone will be able to program new smart contracts for Creditcoin using the same programming language and techniques used for Ethereum. No longer will Creditcoin be restricted to recording credit history. A fully EVM-compatible 3.0 will allow developers to build a wide range of applications, protocols, and more, directly on the Creditcoin blockchain.

Universal Oracle

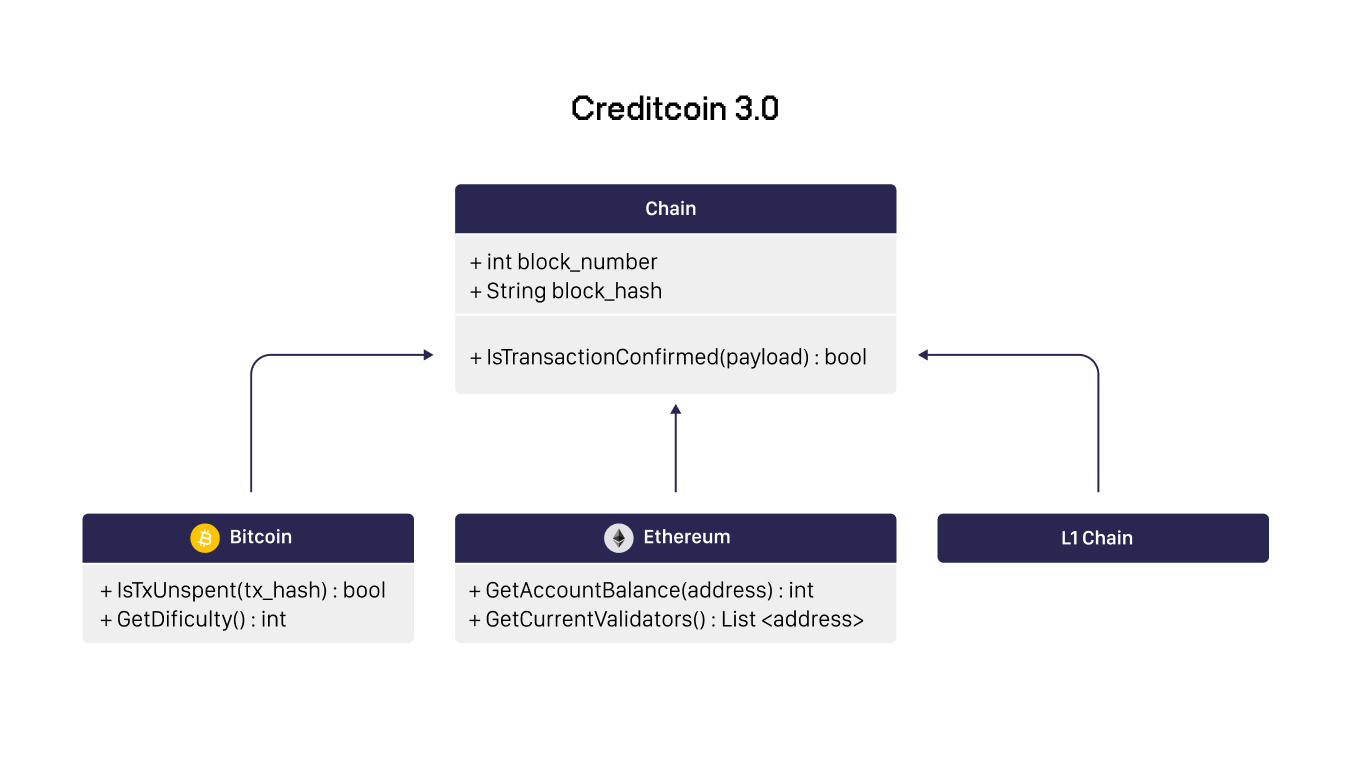

CC3 aims to use Universal Oracles to provide developers with native access to key information about L1 blockchains, such as Bitcoin and Ethereum. This functionality will be achieved through the use of chain objects, which can be utilized to obtain blockchain-specific information.

In the following, the base chain interface will provide a set of attributes and methods that are common across all supported L1 chains, ensuring consistency and ease of use. Furthermore, chain-specific objects such as Bitcoin and Ethereum will offer additional methods tailored to the unique characteristics of each chain. The design will resemble the methods such as msg.sender available on the Ethereum Virtual Machine (EVM), providing a familiar interface for developers.

By providing native access to blockchain information and a standardized interface, CC3 will enable developers to more easily build and deploy multi-chain applications.

Proof-of-Stake

As we’ve mentioned in the recent 2.0+ network upgrade announcement, we will transition our consensus model from PoW to PoS. When we started Creditcoin, PoS was in its infancy, but now we have many working examples, including the recent upgrade of Ethereum.

PoS has multiple advantages over PoW:

- Nodes in PoS networks don’t have to be as powerful or technically complicated as with PoW, helping to enhance decentralization and, therefore, network security.

- The energy consumption by the network is reduced, allowing for lower transaction fees and reduced environmental impact

- 51% hash power takeover problem is eliminated. This risk is especially prevalent for smaller PoW networks due to the mobility of mining power.

- Incentive alignment. In other words, those who have the largest ‘stake’ in the network also have the biggest incentive to help it achieve adoption.

Especially for a new and smaller PoW network, eliminating the possibility of the 51% attack is a critical advantage. On its current path, the network may draw attackers attempting network takeovers as the value of Creditcoin grows. Creditcoin has attracted a considerable amount of hash power (1TH/s), but, in comparison, that is still less than a hundred millionth of Bitcoin.

CC3 Use Cases

Multi-Chain Smart Contract Coordination

Today, most Web3 services are restricted to using a single L1. With CC3, platforms will be able to launch their services across multiple chains, coordinating their multi-chain applications via Creditcoin 3.0.

Take the example of our Gluwa Invest platform, where we connect global retail investors to real world asset (RWA) opportunities. Currently, we only offer USDC ERC20 as a way to fund our investment opportunities. In other words, we’re limited to offering our RWA opportunities to only one chain at a time, just like many launchpads.

In an ideal world, when we’re looking to raise a target of $500,000 for our fintech lending partners, we can launch across multiple chains to maximize our reach. However, cross-chain coordination makes that difficult because Chain X doesn’t know what has been deposited on Chain Y, and vice versa.

Therefore, harmonization is impossible, and the service is forced to restrict its offering to one chain.

Creditcoin 3.0 will solve this problem. By launching a master contract on CC3, with its built-in universal generic oracle, it can coordinate, interact and update other smart contracts, enabling the harmonization of multi-chain smart contracts, and enabling all sorts of new cross-chain applications.

Multi-Chain Marketplaces

Interoperable smart contracts enable multi-chain marketplaces without having to peg your asset to bridges. For example, users can list their NFT on Ethereum and trade for not only ETH but also BNB. The master contract on CC3 can accept the NFT listing on Ethereum, verify payment happened on BNB, and release the NFT to the buyer’s address on Ethereum.

Similarly, you can build multi-chain Uniswap exchanging ETH on Ethereum with MATIC on Polygon.

Creditcoin 3.0’s Multi-Chain Differentiator

You may be thinking that it sounds like other multi-chain ecosystems, such as Cosmos IBC or Chainlink. Not quite.

You see, the requirements of a chain to support IBC are pretty steep and many chains cannot use it. IBC exists between chains: contracts on one can communicate with contracts on another. And if you need to coordinate between contracts on > 2 chains, the communication complexity just gets higher and higher.

In contrast, CC3 is itself a chain. But unlike other chains, it can access blocks of other chains. Visually, you can think of CC3 as a “blanket” over all the chains, while IBC is a bunch of wires between various chains. This key differentiator allows for a significant improvement in multi-chain complexity due to CC3 being more generic and extensible.

Also, when there are N blockchains, a Chainlink dev must deploy N smart contracts, and each of them makes N-1 connections to oracles to connect to all blockchains. The complexity is N squared.

On the other hand, a CC3 dev only needs to deploy 1 smart contract and make N-1 connections to oracles. Depending on the smart contract, even 1 connection.

Other Changes

Gateway DAO is a blockchain-agnostic decentralized bridge under the Creditcoin project. We will embed Gateway DAO into Creditcoin 3.0, with the DAO having CC3 as its mainnet. We propose a token merge between GATE and CTC at a 2:1 ratio.

These changes will create significantly greater simplicity in the Creditcoin ecosystem under the CTC ticker and improve our user experience, especially for new users.

The Migration Process

As we’ve announced, Creditcoin 2.0 is iterated to Creditcoin 2.0+. It will continue to function after Creditcoin 3.0 is live as an L2 on CC3.

In other words, Creditcoin 2.0+ will be a sub-chain of Creditcoin 3.0. The old chain will continue to accumulate credit history, whilst periodically rolling up from the new. We will outline a suitable rollup design when we complete the technical specifications of 3.0.

Closing Remarks

Leonardo Da Vinci famously said, “Art is never finished, only abandoned.” Adapting the saying, “A protocol is never finished, only evolved.” As long as we have a community that shares our vision for the protocol, who wants to help change the world with us, and who has keyboards to help us on our journey, then the heart of our protocol is beating strong!

We’re looking forward to sharing more details on Creditcoin 3.0 in the coming weeks and months. Stay tuned.